October 2011 Archives

CORRECTED to include all Working Tulsans contributions. In my haste to post the list of contributors, I only included those on the printed attachment and missed those on the handwritten portion of the form.

Analysis to come (after trick-or-treat), but for now, here are the ethics reports filed by PACs, candidates, and issue committees as of 4:45 pm today.

Tulsa_City_Election_2011_Pre-General_Ethics_Reports-20111031.pdf

The PDF includes filings for the mysterious "Working Tulsans" group that sent mail on behalf of several candidates (including Jeannie Cue, David Patrick, and Skip Steele) before the primary. Here's the list of contributors, a quick copy and paste from the report.

9/2/2011 George B. Kaiser, PO Box 21468, Tulsa, OK $5,000

9/2/2011 Stacy Schusterman, PO Box 699, Tulsa, OK $5,000

9/2/2011 Jay Helm, 5727 S. Lewis, Tulsa $5,000

9/8/2011,9/23/2011 Burt B. Holmes, PO Box 1440, Tulsa, OK $4,500

9/8/2011 Daryl Woodard, 6311 E. 105th St, Tulsa, OK $2,000

9/8/2011 Stuart Price, 113 E. 22nd PI., Tulsa, OK $2,000

9/2/2011 Paul Lackey, 2200 S. Utica, Tulsa, OK $1,000

9/23/2011 Russell A. Richardson, 3114 E. 81st Tulsa, OK $1,000

10/3/2011 E. Terrill Corley, 1809 E. 15th St. Tulsa, OK $1,000

10/15/2011 George F. Bashaw, Jr., PO Box 52490 Tulsa, OK $500

Daryl Woodard, you'll recall, was the Mayor's appointee to the redistricting commission. Woodard had previously endorsed council-suer Burt Holmes' council-packing efforts. George Kaiser needs no introduction. Stacy Schusterman (a classmate of mine from 4th through 12th grade) is CEO of Samson Investment Company and VP/Treasurer of the Charles and Lynn Schusterman Foundation.

Phil Kerpen, Vice President of Policy for Americans for Prosperity, has a new book out: Democracy Denied: How Obama Is Ignoring You and Bypassing Congress to Radically Transform America -- and How to Stop Him. I have a review copy, provided by AfP, and am reading it now with a review to come in a few days.

The book documents how President Obama is using czars and regulation to implement his left-wing agenda, bypassing Congress and overriding the will of the American people on issues like Internet regulation, cap and trade, union card check, Obamacare, and financial regulation. An interactive chart at ObamaChart.com illustrates these five areas and how to combat regulatory extremism.

Here's a brief trailer that will give you a sense of the book.

The theme of Kerpen's book continues to resonate, as earlier this week Obama announced an executive order to change the Federal Home Affordable Refinance Program. That link leads to a CBN News report which includes a brief interview with Phil Kerpen about the change and how it fits into the pattern described by his new book.

This has been bugging me for a while; an item on tonight's council agenda brought it to mind again.

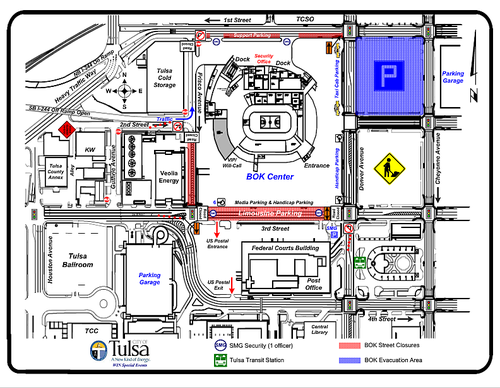

It's bad enough that the construction of the BOK Center permanently blocked 2nd Street, once part of a through pair of one-way streets (with 1st Street) connecting to Inner Dispersal Loop exits and entrances. It's bad enough that downtown west of Denver was already riddled with superblocks that break up the street grid and confuse visitors to downtown.

BOK Center management, with the monthly approval of the City Council, adds insult to injury by entirely blocking off 3rd Street between Denver and Frisco for every BOK Center event, no matter how minor.

The BOK Center event application to the city, covering all November events, calls for closing, for 24 hours on each occasion, 3rd between Denver and Frisco for "Limousine Parking," Frisco between 2nd and 3rd (no purpose specified), a lane of traffic along the south side of 1st Street west of Denver for "Support Parking," and special curbside parking designations for handicap, taxi, and media parking.

Do we really need to block an arterial street for limousine parking for a minor league hockey game expected to draw (according to the event application) 3,000 people?

3rd Street links downtown to the Crowell Heights neighborhood, turning into Charles Page Boulevard and connecting other neighborhoods and businesses along the Sand Springs Line. During periods of construction and heavy traffic, 3rd Street is an important alternate route to the Keystone Expressway. Before the expressway system was complete, 3rd Street, as US 64 / OK 51, was the primary connector between Tulsa and Sand Springs.

While cars entering downtown on 3rd have an easy option -- divert onto 4th at Frisco -- leaving downtown on 3rd have to follow a circuitous route: north on Denver to 1st, west to Heavy Traffic Way, southwest to Houston, south to 3rd. The Heavy Traffic Way intersections are confusing -- it's easy to miss a turn and wind up on the expressway or heading across the river.

Exiting I-244 westbound at 2nd Street, a driver is forced to turn north at Frisco and loop around via 1st and Heavy Traffic Way and then finding some way back into the main downtown grid.

Tulsa has already devoted more than 400,000 square feet of land to the BOK Center. As you can see from the diagram, less than half of that footprint is occupied by the building itself. Surely they could carve out some of the unused area for limousine and support parking, and reduce the inconvenience to Tulsa's drivers, who are inconvenienced enough as it is.

MORE: Note that the BOK Center is expected to host only 10 events in November -- seven hockey games, two concerts (Reba McEntire, Zac Brown Band), and a kids show (Yo Gabba Gabba). Not exactly the wealth of entertainment we were promised. (George Jones, Lindsay Buckingham, Gretchen Wilson, Big and Rich, Kenny Rogers, and Ron White are all performing at Tulsa casinos between now and the end of the year. That's got to be siphoning off potential acts for the BOK Center.)

STILL MORE: The BOK Center website promotes a business called Rock and Bus, which provides luxury bus transportation between other cities and the arena for specific events. For the Reba concert, you can (potentially) catch the bus in Broken Arrow, Stillwater, Muskogee, Oklahoma City, Fayetteville or Fort Smith and pay between $25 and $40 round trip, arriving about an hour before the event and leaving shortly thereafter. (Each city needs 20 riders to get a bus.) It's nice for concert goers and for the BOK Center, but it does nothing for the other downtown businesses that the BOK Center was ostensibly created to help promote. There's no time for Rock and Bus riders to hit the Blue Dome or Bob Wills Districts for dinner or drinks before or after an event. (Presumably, Rock and Bus is one of the limos that gets to use blocked 3rd Street.)

In case you're wondering at the silence here, I got hit Saturday night (shortly after publishing the previous entry) with a nasty gastrointestinal bug that had me up all night. I'm better, but not yet back to normal.

This evening was the first time I felt like spending any time in front of a computer, and I've added a few interesting items to the linkblog (left sidebar on the home page). My pace of publishing will likely remain slow, as I catch up on work and home matters while trying to get an ample amount of sleep. Thanks for your patience.

While Oklahoma voters have closed off most avenues for tax hikes without a vote, there remains one loophole: the sinking fund. As Tulsa County Assessor Ken Yazel explains in the news release below, each taxing entity (a city, for example) presents the county excise board an estimate of the property tax money it will need added to the sinking fund in the coming fiscal year to repay general obligation bonds and judgments against the taxing entity.

The excise board is supposed to analyze the request and determine its validity before approving it, but according to Yazel, the Tulsa County Excise Board has been rubber-stamping requests, resulting in a property tax increase for all Tulsa County property owners once again this year, without any vote of the people.

The property tax increase requested by the City of Tulsa includes money for the final payment of the Great Plains Airlines settlement, a settlement that was thrown out by the Oklahoma Supreme Court well before the Excise Board voted to approve Tulsa's request. Yazel called this to the Excise Board's attention at the meeting on October 19, 2011, but they rubber-stamped the request without any amendments. A motion by one board member, Ted Kachel (appointed by the district judges), to delay the decision until they could learn more about their prerogatives to review and amend requests from the taxing entities died for lack of a second.

Don Wyatt's Boondoggle Blog has a summary and audio of the Tulsa County Excise Board meeting. The apathy on the part of the board's majority (Oklahoma Tax Commission appointee Ruth B. Gaines and Tulsa County Commission appointee Warren G. Morris) is appalling. They don't want to exercise independent scrutiny and judgment to protect the taxpayer.

Wyatt makes an important point: Just because your property value declined doesn't mean that your tax will go down. If the decline in value reflects a general county-wide decline, the excise board will raise the millage rate to keep the same amount of revenue flowing in. It's as if an unelected body had the power to raise sales tax rates to compensate for economic slowdown and a decline in spending.

Here's Yazel's news release:

County Excise Board Raises Tax Rates in Spite of Concerns Expressed by Tulsa County AssessorTULSA, OK.-- The Tulsa County Excise Board approved an increase in property taxes over concerns raised by Tulsa County Assessor Ken Yazel during its meeting held on October 19, 2011.

The county assessor's job is to appraise the fair market value of property in the county. It is the function of the county excise board to approve the amounts requested for property taxes that will be used in the calculation of the appropriate tax levies.

All of the entities receiving property taxes submit an estimate of needs for property taxes to the excise board each year. It is the board's responsibility to analyze those needs, approve the property tax requests, then apply the approved amounts to the certified property values furnished by the county assessor. It is from this process that the amount of taxes each property owner will pay is derived.

Yazel attempted to make the following points to the Excise Board on behalf of the taxpayers:

1. At its core, the county excise board has property tax oversight responsibility. The board has in fact historically voted on property tax rates with virtually no independent analysis of the various estimates of needs.

2. Instead of analyzing the requests as the statutes dictate, the board merely relies on a county employee to provide them with the millage rates. To properly exercise its oversight responsibility, the excise board needs its own independent analyst to help it fulfill this responsibility.

3. Statutes require the excise board to take into account (for all entities requesting property taxes) cash balances and revenues from all sources. The requirement is there so the excise board can determine whether the requesting entity actually "needs" what has been requested.

During the meeting, one excise board member characterized the board's activity over his eight year tenure as "rubber stamping" the millage rates presented to them. He expressed some regret for this and asked the assistant district attorney for a better understanding of the board's responsibilities. Another member stated bluntly that he is incapable of analyzing the requests.

Yazel's position is not that the excise board or the county employee are doing anything other than what has been the practice for years. Rather, he is trying to help the board understand that in an era where cumulative property values are going down and the demand for money and tax rates are increasing, they have broader obligations and authority to review and potentially modify these requests than they have been exercising.

"As an example, I attempted to point out the situation related to the City of Tulsa sinking fund and the Great Plains $7.1 million judgment," said Yazel. "The Oklahoma Supreme Court recently ruled that payment to be invalid. However, the City of Tulsa put the final portion of that payment into their current request for property taxes, having done so before the Supreme Court made its ruling. I was trying to get the board members to see that they were about to raise taxes on the citizens of the City of Tulsa for a payment that the Supreme Court had invalidated. In the end, they approved the request with no changes. This proves the point, that before raising taxes they need to be more deliberative and analytical and not merely accept what is put in front of them as accurate or complete."

Total property tax revenues collected in Tulsa County have risen over the past 10 years from $397 million to an estimated $621 million for the current year, even though in many communities the population and/or the cumulative property valuations are going down. An increasing number of residences are being converted to rentals, and there is some evidence that businesses are locating in neighboring counties because of the marked difference in tax rates.

"This is a trend that is unsustainable in the long run, and that is my concern on behalf of the taxpayers," Yazel said. "It is much easier for public officials to address it now. It will be exponentially more difficult to deal with in the future if this pattern continues."

Ken Yazel was elected Tulsa County Assessor in 2002 and was re-elected in 2006 and 2010. A retired Major, U.S. Marine Corps, Yazel was also a CPA for many years. During his time in county government he has continually fought to lower taxes and ensure that property values in Tulsa County are fair and equalized.

This is old news, but new to me.

We're just back from a brief fall break jaunt to Table Rock Lake, a short trip that included brief stops in Siloam Springs and Eureka Springs on the way there, paddleboating, playing at tennis (and violin) in a giant bubble, a providential encounter with a classic car club (mostly Packards and Cadillacs from the '20s), dinner in an old-English-style restaurant on an old-English-style Main Street in Hollister, Missouri, a timeshare presentation, a visit to a Civil War battlefield, a drive down a 9-foot-wide highway, a moment with some buffalo, and over-indulgence at a classic Route 66 cafe with a neon "EAT" sign out front. More about all that in due time.

A surprise from the trip was the discovery that QuikTrip is no longer in the Springfield, Missouri, market. One QT that had been a frequent stop for us on trips to and from the Branson area was at US 65 and MO 14 south of Springfield. Like the QT near the eastern terminus of the Turner Turnpike, this one shared a building with a Wendy's. Today I was surprised to see that it had become a Casey's General Store. The Casey's convenience store chain is based in Ankeny, Iowa, with over 22,000 employees and 1600 corporate-owned stores mainly in Iowa and adjoining states.

It surprised me that a company as dynamic as QuikTrip would pull out of a market. According to news reports, QT announced in March 2011 that it was selling its five Springfield area stores to Casey's. QT had been in the market since 1994. QT is still in the Phoenix, Tucson, Tulsa, Dallas-Fort Worth, Kansas City, St. Louis, Wichita, Des Moines, Omaha, and Atlanta metro areas. There's only one outlier on the map: A store in Columbia, Mo. According to the QT website, the company has "580+ stores in 9 major metropolitan areas" with over 10,000 employees. (Perhaps they count Phoenix and Tucson as a single metro area.)

A October 19, 2010, CSPnet.com story mentioned that the stores would be sold:

QuikTrip Corp. is looking to sell its five Springfield, Mo., convenience stores, company spokesperson Mike Thornbrugh told The Springfield News-Leader. He said QuikTrip is focusing its efforts on very large metropolitan markets, and Springfield no longer fits the company's plans.

Elaborating on the theme in an April 21, 2011, story in the Evangel College student newspaper, The Lance:

According to Michael Thornbrugh, manager of public and government affairs, QT will be "expanding into larger metropolitan areas where each market can hold 80 to 120 locations. The new QT locations are about 5,700 square feet while all the locations in Springfield are 4,200 square feet."The current economy did not play a role in QT closing some of their stores; Thornbrugh said that QT is growing during the tough economic times. Springfield was a good and profitable market for QT.

Management and staff at the store located next to Evangel have expressed sorrow and disappointment about the QT closing its doors. Many from the Evangel community have been patrons of QT, which opened its doors on March 31, 1995. Thornbrough had this to say to the Evangel community: "Thank you for your loyalty. We will miss the opportunity to be your choice convenience store."

With QT's increasing emphasis on ready-to-eat food, it would make sense to have a large and tight cluster of locations that can be serviced by a regional kitchen facility.

In contrast with QT's major metro focus, Casey's began with locations in small towns of 5,000 or less.

According to Convenience Store News's list of the top 100 chains, QuikTrip is the 19th largest convenience store chain in America, Casey's is 12th.

AND ANOTHER THING: Did anyone else think that new talk radio billboard west of Sheridan on the BA was a QuikTrip ad at first? Put three guys in QuikTrip-red polo shirts on a billboard, and it's likely to trigger an unintended association.

A couple of readers have emailed to express their concerns about the imminent introduction of chloramine into Tulsa's water supply. I am only beginning to study the issue, and it seems there may be reason to worry.

Rather than make you wait until I've thoroughly researched the matter, I've decided to present the concerns expressed by one of these readers, with her permission. I would be glad to post knowledgeable answers to her questions and other points of view on this issue.

Jeanine Kinney made the following remarks at the October 4, 2011, City Council committee meeting:

CHLORAMINEThe Health Department's, the Water Department's and The EPA (Environmental Protection Agency) are claiming that Chloramine is safe for all everyday uses, drinking, bathing & cooking et cetera. Yet, the EPA itself admits that it has no Respiratory, Digestive, Skin & Epidemiological studies on the Human Health effects of Chloraminated water. The limited Cancer studies on Chloraminated water are so few that they are considered inadequate for assessment. Even though these studies show some evidence that Chloramine itself is a carcinogen, NO determination can be made from those handful of studies. The fact is there are not enough scientific data to know if Chloraminated water is safe for any uses for Human Beings.

Thousands of people all over the country and even in other countries have reported severe and life threatening respiratory, digestive and skin symptoms whenever they are exposed to Chloraminted water. These people have proven by avoidance and re-exposure that the Chloraminted water is the culprit for their symptoms. They do not have these symptoms when they are NOT exposed to Choramine and as soon as they are re-exposed their symptoms return. These symptoms fall into exactly the "gaps" in the scientific data about Chloramine's safety and the Respiratory, Digestive and Skin studies that DO NOT exist.

In addition to the immediate health effects that people are reporting from Chloraminated water is the grave concern about the emerging science in the very little known Disinfection By Products (DBP's) of Chloramine. These DBP's are NOT yet regulated, but are turning out to be many magnitudes more toxic than those of Chlorine. (THM's & HAA's)

Finally, Chloramine is much more corrosive to plumbing, lead pipes, copper pipes with lead solder and brass plumbing fixtures, which contain lead. Lead is being leached into drinking water because of the corrosive effects of Chloramine on combinations of these metals. Sometimes the level of lead leached into the drinking water is extremely high. Children from Chloraminated water districts are showing high levels of lead in their blood. And for those of us concerned about our environment, Chloramine is much more toxic to fish, frogs, amphibians and to other aquatic life. Water main breaks with water disinfected with Chlorine rarely does any damage unless the level of Chlorine is extremely high. But with Chloramine, however, even small traces from breaks and leaks, as well as from people washing their cars or watering their lawns can wipe out fish, frogs and amphibians in nearby ponds, streams and lakes. WHY RISK OUR FRAGILE ENVIRONMENT IF THERE ARE BETTER ALTERNATIVES????? And there are alternatives that are safer like:

Enhanced Membrane Pre-Filtration OR

Combinations of Alternative Disinfectants & Disinfection Techniques OR

Mixing well water with surface water to dilute the DBP's (Disinfection By Products) OR

Air Stripping of the THM's (Trihalomethane's), to name a few!

In closing today, I really want to believe in my heart that each of you 9 City Councilors took your position on the City Council in order to help, protect and look out for the best interest of the people of Tulsa. I plead with you to help protect the health of Tulsa's water consumer's. Please oppose the use of Chloramine as it has not been studied for the very health effects that people all over the country and all over the world are reporting.

A week later, on October 11, 2011, Kinney was at another City Council committee meeting to attempt to get answers to her questions about chloramine:

There was a Tulsa City Council meeting, Tuesday, October 11, where discussion with the Deputy Director for the Public Works Department, Clayton Edwards, & City of Tulsa Ammonia (Chloramine) conversion project leader, Joan Arthur took place. There was not one member of the TUMA (Tulsa Metropolitan Utility Authority) Board present for discussion. The meeting was set regarding the postponing the implementation of using Chloramines in the Tulsa public water system. The following concerns were attempted at being discussed, however, the meeting was terminated after a couple were asked and still yet unanswered.Numerous email's & phone calls have been received regarding input and interest in Tulsa's conversion to Chloramine. Chloramine is to be used as a secondary disinfectant for Tulsa water utility consumers and those in surrounding areas, who do and will, purchase water from the City of Tulsa.

You state that Tulsa thoroughly researched the potential impact of the Stage 2 D/DBP rules and the alternatives available to meet the new regulations, for the last ten years. I would like to know exactly what treatment processes were evaluated and why these processes's were ruled out?

You state that the byproducts in some parts of the city, are projected to exceed or be very close to Stage 2 DBP standards. What data are these projections based on? Which parts of Tulsa are "problem" areas and/or areas where the levels of byproducts are projected to exceed standard levels? By how much are these areas expected to exceed the standards?

You state that a small amount of ammonia will be added to the water. Yet, no one, not even the EPA, knows if even a small amount of ammonia is safe since there is NO data regarding how much ammonia is safe in drinking water.

You state Chloramine is less reactive in the distribution system. Yet chloramine, forms many disinfection by products that are much more toxic than the currently regulated, THMs and HAAs. Some examples include iodo acetic acid, NDMA'S and nitrogen containing DBPs, according to the journal AWWA, February 2001. (NDMA is a probable carcinogen)

Using chloramine as a residual does not "adequately" protect people from re-contamination due to water line breaks, road work, construction with water lines and home plumbing leaks. It is also a greater hazard to the environment. Water main breaches and run off into storm sewers, lakes or ponds, kills fish, frogs and other aquatic life.

Chloramine is much more toxic to aquatic life than an equal dose of Chlorine. The edition of even small amounts of Chloramine to aquariums or fish ponds quickly results in death for fish as well as frogs, amphibians and other organisms. This has never happened with Chlorine unless unusually high concentrations of Chlorine were present in the tap water.

You state that trihalomethanes are linked to bladder cancer. The data shows that it takes 70 years of chronic exposure to trihalomethanes, to see a 1.7% increase in the incidence of bladder cancer. Bladder cancer is the easiest type of cancer to treat and has the lowest mortality rate.You state that the maximum residual disinfectant level (MRDL) of 4 mg/ L is approved by the EPA. However, the EPA based this MRDL on studies that are incomplete. The EPA simply substituted data for chlorine, to fill in the "gaps" in the studies on chloramine, since the studies on chloramine were never completed. The EPA has ASSUMED that chlorine and chloramine have similar health effects, but studies from OSHA and NIOSH, prove otherwise.

Chloramine is a much more potent respiratory and dermal irritant than chlorine. It has different chemical properties and reactivity than chlorine.

CHLORINE IS NOT LIKE CHLORAMINE.

You state that you will be monitoring the lead levels in the distribution system for one year. Will you test water samples in homes, apartments, office buildings, schools and other building's in and around Tulsa? And if so how many residences & building's will be tested? How frequently will they be tested & in what manner will they be tested? (When samples are collected, will you take a first draw? Or will your flush/run the water to clear out the pipes? Flushing can miss the lead that may be present in the water, due to chloramine's corrosive effects on plumbing that contains combinations of copper, lead and brass).

You state that chloraminated water is safe for all everyday uses. However, there are NO skin, respiratory or digestive studies nor is there any epidemiological data to prove that statement. It is in fact your opinion. You can verify that these studies DO NOT EXIST, by looking chloramine up in the IRIS, published by the EPA. The EPA DID NOT study the dermal, respiratory, ocular, and digestive effects of chlorimanated water. The limited cancer studies on chloraminated water are considered inadequate for assessment. There is some evidence that chloramine itself is a carcinogen but, we do not know for sure if it causes cancer, what type and at what levels.

The truth is, that there is not enough data to know if chloraminated water is safe for ANY uses, for human beings. Until those studies are done, NO ONE can say that chloraminated water is safe. No studies = WE DO NOT KNOW!

Finally,

You state that currently 30% of all municipal water treatment systems rely on chloramine disinfection and that chloramine has been used for over 90 years. Still, ONLY studies will prove if chloramine is harmful to human health!

You state that neighboring cities like Oklahoma City, Norman, Sand Springs, Lawton, Dallas, Fort Worth, Denver, and St. Louis have converted their water disinfection process over to Chloramine. That DOES NOT PROVE THAT CHLORAMINE IS SAFE!

There are numerous cases in Pennsylvania, California, Washington DC, North Carolina, Texas, Oklahoma, Dallas, Vermont, Massachusetts, Colorado, Maine, Arizona, Florida, Oregon, Colorado, in which citizens are reporting serious health effects as a direct result of using Chloraminated water for drinking, bathing, cooking and other everyday uses of their tap water.

Where is the data supporting the finding that the reported health effects from Chloramine are "isolated?" How do you know the similar symptoms have not occurred in any of the cities using Chloramine that Tulsa has contacted? Did you contact hospitals and clinics, to ask if there had been increased reports of skin, respiratory or digestive symptoms, since the addition of chloramine to their water? How many cities and how many consumer's and residents were contacted? Until you have that information, you DO NOT KNOW what effects Chloramine is having on those residents.

Please do not put Chloramine in our water at the expense of the health of Tulsan's. We are already going to be paying more for an unsafe disinfectant when we should be paying more for a safe alternative!

MORE:

The EPA collection of frequently asked questions about chloramine.

The website of Citizens Concerned About Chloramine (CCAC)

Wikipedia article on chloramine

Last week the Sunlight Foundation Reporting Group published a detailed history of George Kaiser's fortune, a fortune built with care to avoid paying taxes, according to the story's author, Bill Allison.

Allison co-authored The Cheating of America, a 2001 book on "wealthy individuals and powerful corporations avoid taxes." The article quotes figures from that book on Kaiser's success at avoiding federal taxes:

In 1997, the Internal Revenue Service sent Kaiser and his companies tax bills for more than $72 million in back taxes, interest and penalties, covering individual and corporate returns filed from 1986 to 1992. Kaiser filed returns showing his personal income averaging negative $860,000 between 1986 and 1991; his holding company, GBK Corp., and its subsidiaries reported an aggregate loss from 1989 to 1992 of $507,000--some years it made money and paid taxes, others it claimed losses and paid none.

The article tells the story of Kaiser's acquisition of Bank of Oklahoma, which started with a bad acquisition by BOK, followed by a federal bailout:

Bank of Oklahoma had largely avoided making rash loans during the state's oil boom economy that led so many other savings institutions--including savings and loans, 162 of which shut down during the crisis--from going broke. But in 1984, Bank of Oklahoma bought Fidelity Bank N.A., an Oklahoma City-based bank whose books were loaded with bad loans. Kaiser, who was a shareholder and served on Bank of Oklahoma's board of directors at the time, favored the deal, which didn't work out so well. Fidelity's bad loans were a drag on Bank of Oklahoma, which, after declaring a quarterly loss of $51 million in 1986, turned to the Federal Deposit Insurance Corporation for a bailout. The FDIC deemed it essential to the state's economy, and rather than shut it down bailed it out the bank for $130 million. Five years later, after returning the bank to profitability, the FDIC sold it to Kaiser--for $61 million.The deal was a profitable one--by 1998, his shares in the company were worth some $917 million; on April 26, 2011, when the bank issued its last proxy statement, Kaiser's shares were worth more than $2.1 billion, while his foundation held another $251 million of its stock.

According to Allison, the money to buy BOK came as a loan from Kaiser's GBK Corp., which the IRS called a dividend. The IRS's tax bill of more than $48,000,000 was settled for less than $12,000.

Allison links to a 2007 Forbes article in which Kaiser supports Warren Buffett's call for higher marginal income tax rates. But surely higher marginal rates only provide incentive for the sort of tax avoidance that Allison has documented in this article.

I have to take issue with the headline on Allison's article: "Barack Obama's other billionaire: How George Kaiser turned Oklahoma into his personal tax haven." Allison's focus is on Kaiser's avoidance of federal taxes and doesn't mention Oklahoma taxes. However, as long as we're on that subject:

OCPA's AccountAbilityOK online database of Oklahoma spending, revenues, payrolls, pensions, and tax credits shows that George Kaiser claimed over $29.5 million in state income tax credits for fiscal years ending 2009 and 2010, nearly all of it for venture capital investments. BOK Financial Corp and Subsidiaries claimed $10.5 million in Oklahoma tax credits for FY 2010; the bulk of it, $8.3 million, was the Space Transportation Vehicle Provider tax credit.

UPDATED 2011/10/13 with links to further reaction and my interview with KRMG's Nicole Burgin. Just remember, though, BatesLine had the story first, thanks to an email from an alert reader.

This post is worthy of a flashing light, a flaming skull, and 72-point type. Tulsa's taxpayers get our $7 million back.

The Supreme Court of Oklahoma has thrown out the Great Plains Airlines settlement by a 5-4 vote with three of the four dissenters concurring in part. From the decision (emphasis added):

¶26 In the present matter, the settlement was not based on a contract, but rather under the equitable theory of unjust enrichment to the City of Tulsa. The City of Tulsa, at all times, presented the settlement issues to the District Court of Tulsa County. The Judgments Against Municipalities Act does not apply. Therefore, the sinking funds requirement also does not apply. However, since we find the unjust enrichment claim to be unviable and the Statute of Limitations would bar the unjust enrichment claim against the City, we remand the instant matter back to the District Court of Tulsa County to direct the repayment of the settlement funds from BOK back to the City of Tulsa.

See my July 2, 2008, column, The Great Plains Ripoff, for background.

The Supreme Court ruling, sadly, lets Kathy Taylor off the hook for triple damages payable to the taxpayers who brought the Qui Tam suit over the Great Plains settlement. I'd hope Taylor would feel ashamed of ripping off Tulsa's taxpayers as she did, but I don't expect any remorse. The taxpayers of the City of Tulsa weren't as important to Kathy Taylor as the legal and financial well-being of her cronies.

UPDATE: Here's a link to a more readable version of the Supreme Court decision. Thanks to UTW's Jennie Lloyd for the tip.

MORE REACTION (2011/10/13):

City Councilor John Eagleton called it back in 2008 and in 2010, he cited the Great Plains Settlement as one of eight instances demonstrating Deirdre Dexter's incompetence as City Attorney, in a letter urging Mayor Dewey Bartlett Jr to replace her.

News Talk Radio KRMG's Nicole Burgin spoke to me Wednesday afternoon about the Great Plains settlement. You can listen to the full interview via that link. I discuss what should happen with the money repaid by BOK to the City of Tulsa, what lessons should be learned, and speculate about why the Supreme Court's vote was so close.

(My radio chops are very rusty. Way too many ums and ahs. I probably should have asked for a few minutes to gather my thoughts and mentally shift gears from engineering back to politics before doing the interview.)

The KRMG story has a statement from the City of Tulsa:

"The City of Tulsa and the Tulsa Airports Improvement Trust are currently reviewing the Opinion from the Oklahoma Supreme Court setting aside the settlement between the Bank of Oklahoma and the City and TAIT, and considering their options. The City is pleased the Court recognized the City entered into the settlement in good faith, but the ruling by the Court was a mixed result for the City. The ruling obviously will cause BOK to return to the City the $7.1 million the City paid to BOK under the terms of the settlement. The ruling also makes it clear that the City has no liability to BOK arising out of the Great Plains transaction. However, the settlement the court set aside was global in that it included all of the claims BOK had against both the City and the airport. The result is that although the City has no liability to BOK, BOK can now pursue its previous claim against the airport."

KJRH reports that BOK will be resuming its lawsuit against the Tulsa Airports Improvements Trust:

BOK issued a statement to 2NEWS saying, "The Supreme Court's invalidation of the settlement with the City has freed Bank of Oklahoma to assert its $12.5 million claim against the Airport Trust for not fulfilling its obligation to the bank. While we'd hoped this issue would have been put to rest with the settlement back in 2008, the court's decision now requires that it continue."

Here's an idea: BOK should pursue repayment from the investors in Great Plains Airlines, who stood to profit if the airline had succeeded. Or from the vendors who were paid for goods and services with money GPA borrowed from BOK. Or from the individuals and companies that bought GPA's transferable state tax credits. Of the city officials who -- it is claimed -- promised BOK that city would cover any default. If all of the above had an attack of conscience and each paid a bit, they could raise that money very quickly, I imagine.

KOTV's report includes extensive comments from City Councilor Rick Westcott:

"This loan should never have been made. There's nobody that's on the hook for this," said Tulsa City Councilor Rick Westcott...."What is important is the Supreme Court has ruled that the City of Tulsa has no liability to the Bank of Oklahoma. And the Bank of Oklahoma has to give taxpayers back $7.1 million."...

And don't start looking for a property tax rebate check in the mail anytime soon. The money will likely go into an account to guard against future lawsuits.

"The $7.1 million could be used to pay off judgments in the future and not have to levy citizen's property taxes to pay for those small judgments," Westcott said.

Fox 23 seems to get a key point wrong in their brief report. (It's quite understandable.) Kathy Taylor did not say the settlement "was illegal and unfair to taxpayers because it was paid with property taxes." She and the City of Tulsa asked the district court to affirm that the settlement to which she agreed was lawful. The court action that she filed included the complaining taxpayers as defendants. Taylor was pursuing this action to protect herself against liability for treble damages as a result of the taxpayers' claim; Taylor did NOT agree with the taxpayers that her agreement to the settlement was unjust. (See sections 11 through 15 of the Supreme Court's decision.)

Jenks and Owasso voters turned down property tax increases (general obligation bond issues) by overwhelming margins on Tuesday, while Broken Arrow school district voters approved a reallocation of an existing bond issue that involved no tax increase at all.

According to KRMG News, the Owasso tax increase would have amounted to about $170 annually on a $100,000 home, while the Jenks increase would have been about $25 per $100,000.

Complete but unofficial results from the Tulsa County Election Board:

ÂCity of Jenks

Fire equipment, police headquarters

Yes 288 32.99%

No 585 67.01%

Â

City of OwassoProposition 1: Youth sports facilities

Yes 676 14.02%

No 4146 85.98%Proposition 2: Streets

Yes 1,088 22.53%

No 3,742 77.47%Proposition 3: Parks and aquatic center

Yes 779 16.21%

No 4,026 83.79%ISD-3 (Broken Arrow)

Yes 2,671 78.19%

No 745 21.81%

It appears that voters want their elected officials to focus on the basics and even then they want to see good stewardship of existing revenue streams rather than higher rates.

This is the make-do era. We are paying down debt, delaying major purchases, taking few risks, making the most of what we already have. In the current environment, transferring money from homeowners to heavy construction companies for the sake of some nice-to-haves doesn't make much sense.

Tulsa's establishment and elected officials will probably take the wrong lesson from the result and assume a marketing failure. Hire the right PR firm, the right political consultants, and any tax hike will pass. It worked in 2003. It almost worked in 2007.

But not now, not for a long time to come.

Voters in two Tulsa County municipalities and a school district will go to the polls today to vote on general obligation bond issues. General obligation bond issues are funded by a property tax increase -- the millage (tax rate) goes up by enough to cover debt service on the bonds. (It may be that other bonds are expiring so that the overall millage for the jurisdiction doesn't increase, but in any event, the tax rate will be higher if the bond issue passes than if it doesn't.)

Voters in two Tulsa County municipalities and a school district will go to the polls today to vote on general obligation bond issues. General obligation bond issues are funded by a property tax increase -- the millage (tax rate) goes up by enough to cover debt service on the bonds. (It may be that other bonds are expiring so that the overall millage for the jurisdiction doesn't increase, but in any event, the tax rate will be higher if the bond issue passes than if it doesn't.)

Owasso voters have three bond issues to consider, Jenks and Broken Arrow have one each, but Broken Arrow's single bond issue overshadows the other three combined. Links go to sample ballots on the Tulsa County Election Board website; words are from the ballot title:

City of Owasso Proposition No. 1: $11,000,000 "to provide funds for the purpose of acquiring, constructing, and improving youth sports facilities, all to be owned exclusively by the city."

City of Owasso Proposition No. 2: $5,000,000 "to provide funds for the purpose of constructing street improvements, to include sidewalks, curb and drainage improvements, and other related improvements."

City of Owasso Proposition No. 3: $9,000,000 "for the purpose of economic and community development in the City of Owasso, Oklahoma, to include (I) improvements to the following existing city parks: Elm Creek Park, Centennial Park, Rayola Park, Ator Park, Funtastic Park, and McCarty Park, (II) the construction and equipping of an aquatic center to be located at a site to be determined, and (III) the acquisition of land and the construction of a festival park at a site to be determined."

City of Jenks Proposition: $3,515,000 "to provide funds for the purpose of constructing, remodeling, equipping and improving public safety facilities and equipment to be owned exclusively by said city."

Broken Arrow Public Schools, Independent School District No. 3: $73,500,000 "to provide funds for the purpose of constructing, equipping, repairing and remodeling school buildings, acquiring school furniture, fixtures and equipment and acquiring and improving school sites."

The Broken Arrow school bond issue, according to school officials, is a reallocation of $73.5 million from 2009's $295 million bond issue and doesn't represent additional indebtedness or a higher millage rate. Here is a detailed list of which projects lose or gain money in the reallocation. The decision to close two elementary schools -- Indian Springs and Arrow Springs -- is controversial.

Don't forget that the Broken Arrow school district includes a small section of the City of Tulsa, south of 31st St and east of 145th East Ave.

In Owasso, some residents question the usefulness of the proposed park and recreation projects, some wish that more of the money was going to street improvements for Oklahoma's fastest growing city, some wish the proposal would be funded with sales tax, some of which is paid by shoppers visiting Owasso from elsewhere. The Owasso Taxpayer Alliance opposes the three propositions, arguing instead for the use of projected excess funds from an existing sales tax. (The Owasso Taxpayer Alliance also has posted the text of the ballot resolutions -- Propositions 1 and 2, Proposition 3 -- which control how the money will be spent.)

In Jenks, $1.9 million of the bond issue will pay for new fire and rescue equipment, while the remainder would fund the renovation of the public safety building as police headquarters. This is something of a repeat of a failed funding package from 2010, but this time the funding is all property tax, rather than property tax combined with a permanent 3/4 cent sales tax.

Opponents of the tax hike point out that Jenks residents already bear a very high combined sales and property tax burden. Brian Waddell writes:

I have been a resident of Jenks for over 20 years and am dismayed with the direction the city is taking. The property tax rate for the city of Jenks is the highest in the county and is higher than the average of most of the surrounding states. According to the County Assessor, the per person tax burden (includes sales taxes) for Jenks residents is also the highest in the county.And now I see the Jenks school will also be asking for more in property taxes to meet their needs. Is there no limit to our local government needs? It appears not.

It's been said that Jenks residents should pay their fair share. Well, it looks to me that we are.

Given the sorry state of the economy, now is not the time to raise taxes of any kind.

Our local government officials should look at their own budget first and make cuts however difficult to save the money for their capital needs. A 2.5% cut in their budget would generate $700,000 per year. In 5 years they could have their equipment, office space and state of the art training center without increasing property taxes one dime.

Jenks should reduce the size of its government, reduce taxes and watch the businesses and consumers flock to this side of the river.

I am voting NO on the bond election. It's your money no matter how little they are saying it's going to cost you. Who will move to Jenks when it has the highest property tax rates in the state? Put that on your Chamber brochure.

(Posted at 12:00 a.m. on 2011/10/11, postdated to 7 p.m. to remain at the top throughout election day.)

Here's my eldest son's performance from Saturday's Oklahoma State Fiddling Championship at the Tulsa State Fair. He finished fourth in the junior category (ages 13-16), performing "Liberty," "Ashokan Farewell," and "Faded Love."

He decided to enter about a week before the contest. He hadn't been sure whether he'd have to time to perfect fiddle tunes in the midst of regular schoolwork and the amount of time he spends practicing classical violin. (The generous prize money helped to persuade him -- he won $50, and every contestant in his category went away with at least $20.) I'm very proud of him. It's amazing to see how his showmanship and musicianship has grown since starting to learn violin over five years ago and entering his first fiddle contest four years ago.

The Oklahoma fiddling championship keeps growing and improving. This year, the contest was inside, on the lower level of the IPE Building (aka QuikTrip Center) on the Muscogee Creek stage (where in years past the Chinese acrobats used to perform).

MORE: Scott Pendleton, dad and rhythm guitarist for the Pendleton Family Fiddlers, has written a comprehensive cover story in the October 2011 issue of Tulsa People about Tulsa's fiddle scene, including local acts, venues, and jam sessions. That's Scott on the left in the video playing rhythm guitar, as he did throughout the contest.

An article by A. Barton Hinkle, on the website of Reason, the magazine of the libertarian Cato Institute, points to Oklahoma's pseudoephedrine restrictions and their impact on the methamphetamine trade, and not in a good way, in a column about proposed legislation in Virginia:

Second, it almost certainly will not impede the meth trade; it will only increase consumption of meth from Mexican narco-labs. This isn't mere speculation. It's exactly what happened in Oklahoma, which imposed restrictions on the sale of cold and allergy medication several years ago to combat meth trafficking there.Result? "Six and a half pounds of Mexican meth, also known as 'Ice,' has been taken off the street by the Oklahoma Bureau of Narcotics," reported an Oklahoma City TV station last year. "It's the second meth bust in the last week." The story quoted the head of the state narcotics bureau, who said, "The No. 1 threat to the citizens in the state of Oklahoma is the Hispanic sell groups that have infiltrated rural Oklahoma." Oklahoma did not reduce consumption--it outsourced production. Some victory.

Third, the proposal targets the wrong thing. The problem is meth, not meth precursors. Cold and allergy remedies can be used to make meth, but so can soda bottles and coffee filters. Applying the fanatical logic of the nation's drug war, if restricting the sale of allergy medicines does not stop meth use--and it won't--the next step should be to track the sale of 2-liter soda bottles.

The column also compares the logic behind pseudoephedrine restrictions to the thinking behind gun regulation:

That warped reasoning goes like this: Millions of Americans use a lawful product in a lawful manner, but because a minute fraction use it unlawfully, everyone else will have to submit to government monitoring, inconvenience and constraint. Including you, dear citizen. Because while you have given no one any grounds to think you have broken the law, it is theoretically possible that you might do so at some point in the future. You are not to be trusted.

I supported the current pseudoephedrine restrictions when they were first approved, but it seems that the 2004 law only temporarily slowed meth usage for so long as it took addicts and their suppliers to find other sources.

Hinkle's argument does overlook some advantages of imported Mexican meth over local manufacture: Fewer houses blowing up or burning down, fewer kids exposed to the toxic fumes of their parents' meth labs.

Still, someone buying a decongestant for its intended purpose shouldn't have to worry about being eyed with suspicion, and they shouldn't have their medical needs unmet because the state's pseudoephedrine computer tracking system is offline -- or, worse yet, going to jail because they accidentally bought more than their allowed amount:

Consider what happened to Sally Harpold, an Indiana grandmother who was hauled off in handcuffs, booked and embarrassed on the front page of the local paper a couple of years ago. As Reason magazine's Jacob Sullum reported, her crime--if you want to call it that--was "buying a box of Zyrtec-D allergy medicine for her husband, then buying a box of Mucinex-D decongestant for her daughter at another pharmacy less than a week later. That second transaction put Harpold six-tenths of a gram over Indiana's three-gram-per-week limit" for pseudoephedrine.

A RESPONSE (2011/10/15): A reader familiar with Oklahoma's drug situation writes to say that the song and dance you go through to buy Sudafed is worth it, and that Oklahoma's law has been a phenomenal success, eliminating the "horrible boobytrapped biohazard dens" that anyone might encounter -- motel rooms, renthouses, cars. The current pseudoephedrine law has brought that problem to an end, along with the corruption and violence of the meth production industry. No one would wish meth labs on Mexico, but better there than here, and in Mexico meth production is not done in small labs, but in remote, large-scale factories. Pseudoephedrine has been illegal in Mexico since 2008 and has to be smuggled in, adding a layer of expense, complexity, and vulnerability to their operations that law enforcement both inside and outside of Mexico can exploit.

AND A NEW TWIST: Last week the arrest of a man carrying a backpack meth lab in the 81st and Lewis Walmart in Tulsa led to the discovery of a meth lab in a storm sewer nearby:

Roy Teeters who oversees the storm drainage system for the City of Tulsa Public Works Department says there are more than 1,000 miles of storm drains in Tulsa.Sizes range from a basketball to a dump truck.

The tunnels are large enough to attract a meth cook who used one of those tunnels as his kitchen.

Police say a hundred yards back through the tunnel that drains into Fred Creek they found they found an active meth lab, a discarded bottle used to make meth and meth-making materials....

However, it just wasn't the meth cooks down in the tunnels.

Officers say homeless people were living in the tunnels.

They found a couch, a chair, clothes and stolen property.

In 2011, Tulsa has already passed the number of meth lab busts we had in 2010.

Earlier this week, in my entry about the passing of Twyla Mason Gray, I mentioned the fascinating collection of interviews from 2007 that makes up the OSU Women of the Oklahoma Legislature oral history project.

Earlier this week, in my entry about the passing of Twyla Mason Gray, I mentioned the fascinating collection of interviews from 2007 that makes up the OSU Women of the Oklahoma Legislature oral history project.

Cleta Deatherage Mitchell represented Norman in the State House of Representatives as a Democrat from 1976 to 1984, during which time she rose to the chairmanship of the appropriations and budget committee. Nowadays she's a Washington, D. C., attorney, a member of the National Rifle Association board, chairman of the American Conservative Union Foundation, and president of the National Republican Lawyers Association. She began working on national issues with her advocacy and legal defense of term limits. Her law practice focuses on election law and lobbying and ethics laws.

As you can see in the following quotes, Mitchell believes that politics should not be run by a professional class, but by ordinary citizens, taking time out to serve their fellow citizens.

In the interview, Mitchell also explains why smaller districts are a good thing, a timely reminder as some of our legislators are toying with the idea of fewer legislators and as Tulsa voters face a ballot initiative that would add three members elected at-large (citywide) to our City Council. (Emphasis added.)

I recommend everybody run for office. I really think everybody ought to serve. I really think it is a bad thing that we've come to this professionalization of politics because that isn't what this country was founded on. This idea--to have a really representative government, you have to have a system that allows people to take turns and go and spend a tour of duty in a legislative body or a city council or a planning commission or a school board. Those are the people who, in my view, really deserve the credit because those are generally volunteer positions. I decided I didn't want any part of people trying to get me to run for the Norman City Council. I said, "Do I want people calling me in the middle of the night because there's a dead dog in their street? No, I don't think so."Frankly my remedy for the cost of congressional campaigns is that one of the things we ought to do is to triple the size of the U.S. House of Representatives. It's not written in the Constitution that we have 435. They used to increase them. Cut the district sizes by two-thirds so people can get to know and do those grass roots door-to-door campaigns. I mean, that was such an important part of my learning process to become a legislator was the campaign. I would bring home zinnia seeds and watermelons and people would give me money--twenty bucks and, I mean--"Come back and get some of this squash from my garden," and I talked to people. My, campaign staff, my volunteers would say, "You are the slowest canvasser." Well, that's true because I really talked to people, and I really learned from them and listened to them. It's not easy for candidates to do that, running for Congress or the U.S. Senate now because it's all television. It's fundraising and television and they don't re-draw the state boundaries every ten years so Senators actually do have to maintain the boundaries. But for House members I really think that we've lost something in the retail politics that I think we could get back if we changed the system some.

I think everybody ought to do it, and I think people who think they're not qualified--women always say they're not qualified. That's the first thing they always say. They're not qualified. And I say, "Well, if you don't think you're qualified, then you just need to do what I did. Go sit in the gallery. Go listen. Turn on C-SPAN. You know, watch the local access channel. Watch your city council, and if you think you're not qualified, you are just not paying attention."...

Women always think, "Well, I need to go get another degree or I need to get another course." And I always say, "One more piece of paper is not what you need. You just need to know that you know what you know and you bring what you know to the table. And in a representative government, that's what we're supposed to have....

Listen more than you talk. Take care of the home folks. And work, work, work.

As you'll read in the transcript of the interview, Mitchell was instrumental in the Open Meetings Act, the restoration of the State Capitol building, an end to unrecorded votes in the legislature (the "Committee of the Whole"), the computerization of voter records, the redirection of state sales tax receipts from being earmarked for Lloyd Rader's welfare empire to the general fund under the legislature's control, and "displaced homemaker" training programs at the state's VoTech schools.

MORE:

Cleta Mitchell in the Daily Caller: Setting the record straight on voter ID laws

Back in February, RedState's Erick Erickson defended Mitchell for her devotion to the conservative cause, contrasted with her detractors' in GOProud and their support for left-wing groups and causes.

Yesterday, Tulsa Congressman John Sullivan's bill to provide regulatory relief to the American cement industry, HR 2681, passed by a vote of 262-161. According to an email from Sullivan, the bill "puts the brakes on a costly, overbearing EPA rule that threatens to shut 20% of the U.S. cement manufacturing industry. This rule, refered to as the 'Cement MACT' rule could end up costing us nearly 20,000 private sector jobs and would drive up the cost of cement and construction projects around the country."

To underscore the significance of the bill, the free-market grassroots group FreedomWorks made it a "key vote," a vote included in its rating of each congressman's commitment to economic liberty. FreedomWorks president Matt Kibbe explains the impact of the Cement MACT rule and why Sullivan's bill matters:

The EPA itself admits that current cement regulations would raise the price of the most common type of cement. The agency predicts that cement prices would go up by 5.4 percent. The rules require that the producers of Portland cement invest in expensive new equipment to comply with the new standards. The compliance cost of these new cement regulations over the next four years will total $5.4 billion. Increased compliance costs will ultimately be passed onto consumers in the form of higher prices. We will all be paying higher prices for cement as a result of these needless regulations.The cement industry estimates that the rule could destroy as many as 4,000 jobs. It could cut domestic cement manufacturing capacities by 20 percent over the next two years. Portland Cement Association President Aris Papadopoulos says that, "shortages and price volatility will become more common" once these regulations are implemented. In addition to destroying jobs in the cement industry, the regulation is expected to cost 12,000 to 19,000 jobs construction jobs due to higher construction costs. We must prohibit the cement MACT rule to save jobs and prevent the increase of cement prices.

Americans for Prosperity issued a letter of support for Sullivan's bill, noting many of the same points (with links to backup material for the numbers cited):

For weeks the President has lectured us that the government needs to help "put people to work rebuilding America" - destroying jobs and hiking up construction costs through poorly-contrived regulation is no way to start. Your bill provides relief from these rules: giving EPA fifteen months to re-propose and finalize more prudent standards, extending compliance deadlines to give cement plants adequate time to adapt once the rules do take effect, and ensuring that EPA chooses the "least burdensome" and most economical regulatory alternative.

Here's Sullivan's speech on the floor of the House during debate on the bill.

The American Planning Association has named Tulsa's historic Swan Lake neighborhood one of ten Great Neighborhoods for 2011, part of the APA's annual recognition of "Great Places In America." (Hat tip to KRMG News for the story.)

From the APA's citation:

What dominates this attractive and popular neighborhood are the well-maintained sturdy bungalows built along tree-lined streets between 1920 and 1930. Apartment buildings, which meshed with the development's middle-class appeal, appeared on outlying streets as early as 1918. One innovative apartment complex built in 1929 featured a courtyard at its center to provide outdoor recreation space for its tenants. Duplexes and garage apartments -- many from Swan Lake's earliest days -- continue to attract singles, young couples, and empty-nesters.Once a spring-fed watering hole, Swan Lake eventually became a community gathering place and the site of a 1910 amusement park. Today the lake and surrounding park, a popular bird watching spot, are the focus of neighborhood attention as residents raise funds to restore a 1920s stone fountain.

Finding solutions to commercial encroachment is another focus of residents. The neighborhood is within easy walking distance of the very popular Cherry Street retail and restaurant corridor, several medical facilities, and other businesses. The Swan Lake Neighborhood Association, which initiated a successful effort to add a historic preservation zoning overlay, supports efforts to keep commercial development on the perimeter of the neighborhood from expanding into the residential district.

Another positive feature noted by APA is the mix of housing: More expensive, larger single family homes around the lake and around the southern end of the neighborhood, a mix including smaller bungalows and brick apartment buildings through the northern half of the neighborhood. This is a neighborhood where you could find housing suitable for any stage of your life. The couple that spends $100 for dinner and drinks on Cherry Street lives in the neighborhood; so does their waiter and their bartender and the barista who makes the lovely designs on their after-dinner lattes.

Historic preservation has helped to preserve that diversity of housing stock. You can see what happens without that protection by heading north of Cherry Street -- affordable bungalows and brick apartment buildings replaced by $300,000-plus townhomes (which are now selling at a deep discount from their peak prices). Speculation replaced affordability for which there was a demand with luxury which apparently lacks strong demand at the moment.

Note the balance in the APA's description -- walking distance of popular shopping districts is a good thing, but protection of the residential area against commercial encroachment is important, too, especially since new commercial development is likely to be larger in scale, be less attractive, require more off-street parking, and use lower quality building materials and techniques than the commercial development from the 1920s and 1930s along Cherry Street.

The APA specifically salutes legislative efforts to prevent that encroachment:

- Organized in 1983, Swan Lake Neighborhood Association launched a successful campaign (1992) to list neighborhood in the National Register of Historic Places (1998)

- City approves neighborhood petition for Historic Preservation overlay zoning for Swan Lake and adopts design guidelines (1994)

- Residents support legislative efforts (2011) to close loophole permitting commercial development within boundaries of Historic Preservation Zoning districts

- City council places a moratorium, to expire December 1, 2011, on use of planned unit developments to amend zoning in historic districts

- As part of implementing its recently adopted comprehensive plan, PLANiTulsa, City allocates $300,000 to develop three small-area plans, including one that incorporates those parts of Swan Lake adjacent to commercial and medical corridor

I discussed the HP / PUD loophole at length back in May, when the City Council voted for the temporary change to the zoning code to close that loophole. The sunset clause was a vain attempt to placate the build-anything-anywhere lobby and keep them on the sidelines during the election. As I predicted, the Council's pusillanimity on this issue did not inoculate them from opposition and defeat, despite their hopes to the contrary. The new council, elected with chamber and developer money, is unlikely to remove the sunset clause or even to extend the moratorium.

It's probably too much to hope, but before the new council is seated the current council could, without going back to the TMAPC, vote to remove the sunset clause from the ordinance. (The TMAPC made a recommendation on the proposed ordinance back in May; they would not need to be consulted again.) It would be a positive legacy for the outgoing councilors -- protecting the integrity of a nationally recognized neighborhood, a jewel in Tulsa's crown, keeping speculators from killing the Swan that laid the golden egg.

If you want to know what the build-anything-anywhere lobby will do, given the chance, just look at Bumgarner's Folly, the big vacant lot south of 14th Street between Troost and Utica Avenues. Already, developers have eroded HP-zoned neighborhoods along Utica by razing protected homes for parking as part of PUDs for large office buildings.

Last week, at the Forest Orchard neighborhood association candidate forum, I asked Ken Brune, the Democratic nominee for the District 4 council seat, "Do you think the HP boundaries ought to be respected, or are they negotiable for the right project?" Brune's response: "I think it depends upon the project.... I think that those decisions have to be made on a case by case basis as to whether you make any changes with regard to the rules. The rules are there, the rules need to be followed, unless of course a certain project that there be an exception.... " His opponent, Republican nominee Blake Ewing, has made several clear written statements on the moratorium and on historic preservation in general:

Does he support the moratorium on PUD's in HP Districts?

Yes.Will he vote to extend it if no small area plans are in place to protect HP District boundaries when it is set to expire in December?

Yes, though I really want to see us get to work on those small area plans.

Did the White House try to strong-arm a journalist in the wake of the Justice Department's "Operation Fast and Furious" scandal? CBS News correspondent Sharyl Attkisson says government leaders took a very aggressive tack following her revelations earlier this year.On Tuesday's Laura Ingraham Show, Attkisson said DOJ spokeswoman Tracy Schmaler and White House associate communications director Eric Schultz yelled and screamed at her over the story.

"The DOJ woman was just yelling at me," Attkisson said. "The guy from the White House on Friday night literally screamed at me and cussed at me. Eric Schultz -- oh, the person screaming was Tracy Schmaler. She was yelling, not screaming. And the person who screamed at me was Eric Schultz at the White House."...

Attkisson also said the DOJ and White House representatives complained that CBS was "unfair and biased" because it didn't give the White House favorable coverage on the developing scandal.

"Is it sort of a drip, drip. And I'm certainly not the one to make the case for DOJ and White House about what I'm doing wrong," she added. "They will tell you that I'm the only reporter, as they told me, that is not reasonable. They say The Washington Post is reasonable, the LA Times is reasonable, The New York Times is reasonable -- I'm the only one who thinks this is a story, and they think I'm unfair and biased by pursuing it.

I imagine the Nixon administration thought that Woodward and Bernstein were being unreasonable, too. Sometimes the most important story is the one that only one reporter has the guts to pursue.

In today's Wall Street Journal's William McGurn explores Tulsa billionaire George Kaiser's motivations in his involvement in Solyndra. Some excerpts:

The George Kaiser Family Foundation in Tulsa, Okla., was the company's largest shareholder. The family foundation has attracted attention because it is set up as a "supporting organization" for the Tulsa Community Foundation. Supporting organizations provide donors with generous tax deductions while they are not required to give away the 5% of assets that, say, a private foundation must....No doubt Mr. Kaiser's charitable giving has done some wonderful things for Tulsa. Unfortunately, when it came to a politically fashionable cause, Mr. Kaiser's concern for the taxpayer simply vanished. In its place was a much less appealing ethos, which he alluded to in the same Rotary speech where he spoke about "guilt."...

...As Mr. Kaiser appreciates, an oil man who denounces fossil fuels will be lionized even as he continues to make millions off them, in the same way that a billionaire such as Warren Buffet earns praise for calling for higher taxes. But if you are a businessman such as David and Charles Koch, and you use your wealth to try to preserve the economic freedom you believe will help others move up the ladder, you will soon find yourself branded as an enemy of the people.

"We're all familiar with the greedy businessman who pushes taxpayer subsidies to enrich himself," says Scott Walter, a former domestic policy adviser in the Bush administration who now writes for PhilanthropyDaily.com. "Solyndra tells us we might want to start paying more attention to the businessman who's already rich--but seeks to salve a guilty conscience by putting taxpayers on the hook for his pet causes."

(If you're not a subscriber to the Wall Street Journal, you can read McGurn's entire piece for free by entering the site via a Google search for the title, "Solyndra and a Billionaire's Guilt Trip.")

McGurn's last paragraph quotes Scott Walter's article on Philanthropy Daily, "The Other Solyndra Scandal," which is worth your attention. Walter goes deeper into the special nature of GKFF and the tax advantages of this arrangement vs. direct charitable giving or setting up a traditional foundation. Effectively, you can set aside money for charitable purposes and take the tax deduction now, but wait until much later to decide how to spend it, maintaining control over the money in the meantime. (Idle thought: If you needed the money at some future time, could you take it out? What would be the tax consequences? Penalties, or just taxable at the time you withdrew it?)

A couple of excerpts from Walker:

Kaiser explains that "there's never been more money shoved out of the government's door in world history and probably never will be again than in the last few months and the next 18 months, and our selfish, parochial goal is to get as much of it for Tulsa and Oklahoma as we possibly can."Is this zealous grab for other people's money greed? The dollars at issue weren't voluntarily donated by generous fellow citizens, nor were they knowingly risked by venture capitalists gambling with their own money. No, the dollars Mr. Kaiser sought to get his "selfish" hands on were tax dollars that his fellow citizens were compelled to provide, supposedly for the common good....

Why isn't it greedy and improper when a billionaire with enormous charitable resources - $4 billion in the George Kaiser Family Foundation as of 2009 - manipulates tax dollars into a dubious hobbyhorse project of his? Especially when that hobbyhorse is a for-profit company in which the billionaire's foundation is the largest stockholder? And when the billionaire's foundation ends up, at bankruptcy time, ahead of the taxpayers in the line to recoup something from the cratered company's assets, even though federal law appears to make it illegal to put private investors ahead of taxpayers in such circumstances?

I am still trying to get my mind around the motivations and actions surrounding George Kaiser, GKFF, and TCF. Solyndra is just the latest episode in a long-running drama that includes -- on the negative side of the ledger -- Great Plains Airlines (and the taxpayers' ultimate payback of money we didn't owe to Kaiser's Bank of Oklahoma), the downtown baseball stadium (and the heavy-handed approach to its surrounding development), the mediocre candidates Kaiser has backed for public office in Tulsa, the county river tax, and -- on the positive side -- RiverParks trails improvements, supplemental funds for beautification for new public construction, financial support for the comprehensive plan process and the city government efficiency study, purchase and preservation of the Blair Mansion and grounds, support for the Tulsa Fab Lab, and financial support for countless worthy projects and programs.

It's a complex picture. I don't buy the idea that Kaiser is all about building his own wealth. I don't buy his explanation of his success as "dumb luck," and I don't think he does either. Some describe Kaiser as very hands-off when it comes to spending his money, and that he lets himself be driven by what the community wants, but that doesn't entirely square with the facts either. (And who has the standing to define what the community wants for him?) Even if his motivation is purely altruistic, his vision of the good may be entirely at odds with that of his intended beneficiaries. Potentially, he could be a kind of cultural imperialist, with Oklahoma as his mission field.

Leverage and control are two recurring themes. It's a commonplace in Tulsa that money from GKFF comes not with strings attached, but with chains.

Because of his connection to Solyndra, who George Kaiser is and what he wants is a matter of curiosity for the rest of the world. Because of his economic power and his focus on Tulsa, who George Kaiser is and what he wants is a matter of critical concern for Tulsans.

Twyla Mason Gray, an Oklahoma County District Judge and former Oklahoma state representative died Monday. She was 56.

In 1980, as a 25-year-old, Twyla Mason filed for and defeated an incumbent to win District 23 in the Oklahoma House of Representatives. As a House freshman, she met and married Rep. Charles Gray from southwestern Oklahoma, the only time in state history that two sitting legislators married each other. After two terms in the House, Mason Gray left to raise a family and to attend law school.

In 2007, Twyla Mason Gray was interviewed as part of an oral history project documenting the experiences of Oklahoma's female legislators. In part of the interview, she discussed the birth of the University Center of Tulsa, exploiting a mistake made by the legislative leaders seeking to block the bill and the petty revenge that followed (emphasis added). "Triple-assigned" means that a bill would need the approval of three different committees before reaching the House floor:

One of the things that was the most important to those of us from Tulsa County was the University Center of Tulsa. Sometimes everybody plays a small role, but every role is important, and that's kind of what happened in that bill. Jim Williamson, who was a House member then from Tulsa...my husband taught us both how to roll call a bill, and I did the democrats and Jim did the republicans--and what happened on the bill was that with Cleta Deatherage representing OU [University of Oklahoma] and the Speaker of the House, Dan Draper representing OSU [Oklahoma State University], we couldn't get the bills out of committee. They made a mistake in the appropriation process and they did not move the higher education appropriation bill out of the Appropriations Committee by deadline. The next day I was reading the journal and saw that it had not come out. Bob Hopkins, was the older statesman of the Tulsa delegation, and I went running to Bob on the floor and said, "This bill is still in the committee." Well, I had called to check to see if the bill wasn't out of committee. I had called the chief clerk's house to see if it was a mistake and, of course, they went to the chief clerk, who was Richard Huddleston, and said a mistake had been made. He told Draper, and Deatherage got up to ask for unanimous consent that the bill be moved, and Bob Hopkins objected and then the fight was on because we had taken this roll call to keep the bill in committee until we got the University Center of Tulsa.We were able to keep that bill from coming out for four days which was a big deal when you're opposed by the Speaker of the House and the Appropriations chair. They can make a lot of promises and people begin to fall off, but eventually we got it--but it was hand-to-hand combat every day. In fact, one of the things that happened because it was close to the end of session was in the leadership meeting there was a big battle because my husband, who was on the leadership, had helped us roll call the bills and had taught us what to do and had coached us about how to talk to different people. There were folks who were really mad at him and they got into a big fight. The leadership didn't meet the rest of the year. Their weekly luncheons were cancelled. It was an exciting time....

In 1982, when I was re-elected, my husband retired and Dan Draper was still Speaker of the House and I got punished for the University Center of Tulsa and so Dan took my office, and there was a variety of things that went on. All of my bills got triple assigned. I had been able to accomplish the split in the leadership, I had Vernon Dunn and Charley Gray helping me against the Speaker, and it was a big deal and so there was a change in the Speaker of the House. Jim Barker was elected, and then everything changed and kind of went back to normal. That first session I had very little to do because I couldn't get anything done, and so I sort of did what I called guerrilla warfare. I didn't have anything to do other than to read their bills and to ask irritating questions, and so that's pretty much what I did. Then when Jim Barker was elected Speaker things leveled out and I worked on legislation and could get my bills out of committee and...

(Draper represented Stillwater, home of Oklahoma State University in the house. College towns strongly opposed Tulsa having a local state college.)

Gray was first elected judge in 1998.