Council to change tax ordinance to enable Gilcrease demolition

Back at the beginning of March, we reported that Gilcrease Museum would not be renovated and expanded, as Tulsa voters were promised in April 2016, but would instead be demolished and rebuilt as a smaller facility, with the help of funding from the University of Tulsa and other donors.

Back at the beginning of March, we reported that Gilcrease Museum would not be renovated and expanded, as Tulsa voters were promised in April 2016, but would instead be demolished and rebuilt as a smaller facility, with the help of funding from the University of Tulsa and other donors.

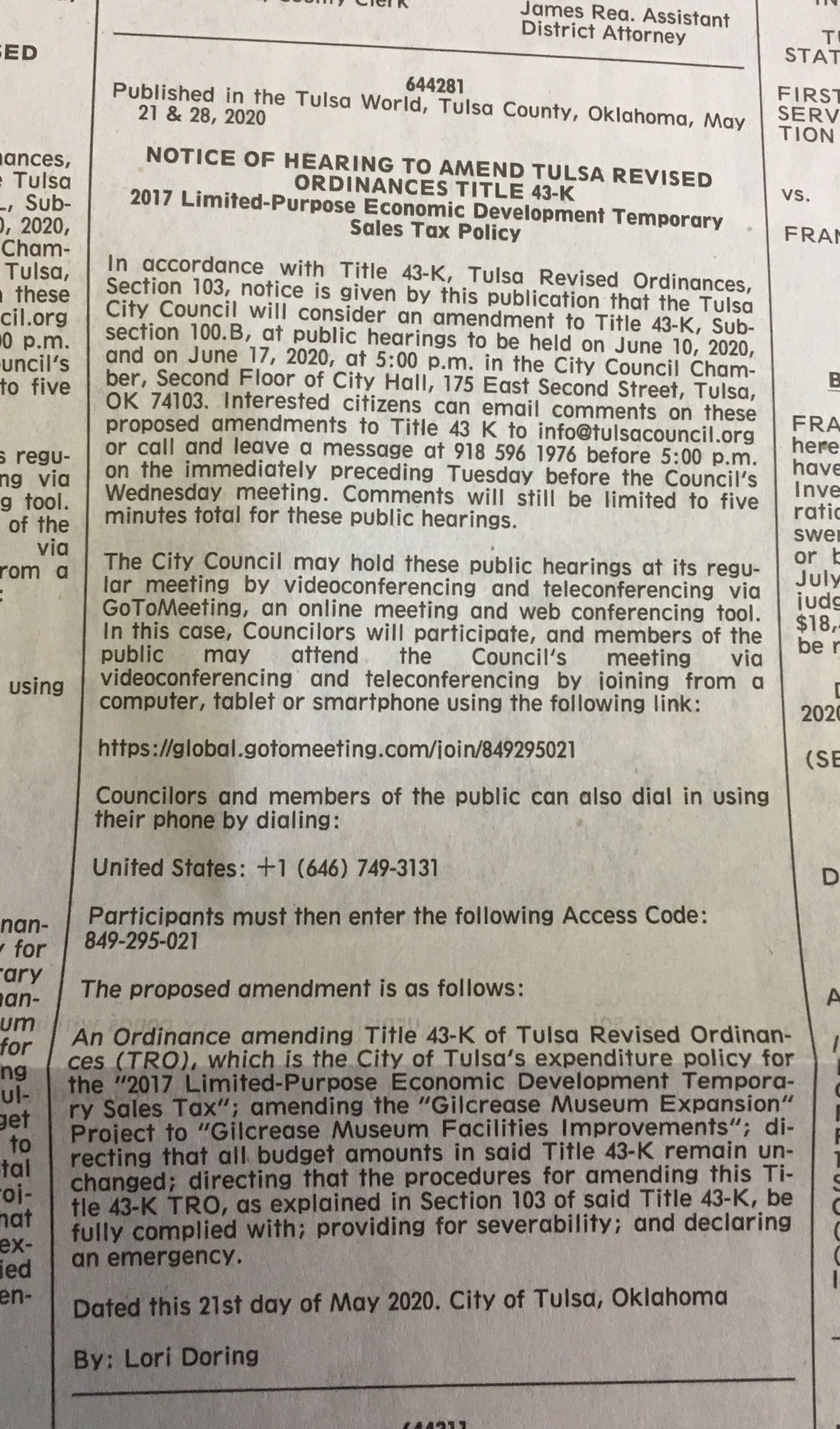

The change is substantial enough that the new plans will not fit within the broad language of the "Brown Ordinance" adopted in advance of the April 2016 tax vote, so the provisions of the ordinance have been invoked and a legal notice has been published, announcing public hearings on June 10 and June 17, 2020, to consider an amendment to Title 43-K to change the name of the line item "Gilcrease Museum Expansion" to "Gilcrease Museum Facilities Improvements."

The "Brown Ordinance" is named in honor of former City Attorney Darven Brown. City of Tulsa capital improvements were traditionally financed by general obligation bond issues (repaid by property taxes) or revenue bond issues (repaid by, e.g., water and sewer customers, parking garage customers, airline passengers). In 1979, Mayor Jim Inhofe attempted to pass a one-cent sales tax to fund a backlog of capital improvement needs, but the vote failed, in part because a sales tax, once in effect, could be spent on anything, even operational costs, unlike a bond issue, which could only be spent on the named improvements. Brown came up with the idea of an ordinance which set out the specific projects to be funded and the amount allocated for each, provided for a Sales Tax Overview Committee to monitor spending, provided for a process to ensure sufficient public notice of proposed changes, and established penalties (including removal from office) for spending any of the money contrary to the ordinance. With the Brown Ordinance in place (and with the Zink Lake low-water dam removed from the package), the sales tax passed on Inhofe's second attempt in 1980. A Brown Ordinance has been enacted for each city capital improvements sales tax vote ever since.

Title 43-K is the Brown Ordinance attached to the 2016 Vision Tulsa tax. It was amended within a year that of its passage. The promise that the South Tulsa/Jenks low-water dam would be cancelled and its $64 million in funding reallocated if Tulsa and the Muscogee Creek Nation could not reach a partnership agreement by December 31, 2016, was nullified in February 2017 and replaced with a deadline at the end of this year. (The original proposed change was to a vague deadline of "within a reasonable time.") The ordinance was changed again in May 2019 to move all $3.6 million designated for OSU-Tulsa to increase the BMX World Headquarters funding from $15 million to $18.6 million.

I hope that Tulsans will register their objections to this proposal publicly through social media and with their city councilors. Tulsans voted for expansion of Gilcrease, not contraction, not relocation, and certainly not demolition of this historic facility. The proposed new language doesn't fit the announced plans: Total or near-total demolition can hardly be considered a "facilities improvement." This could be considered an attempt to deceive in the legal notice and could subject the councilors to lawsuits and removal from office if they go ahead with it. Tulsans should insist that their councilors approve an honest title for the line item: "Gilcrease Museum: Demolition and reconstruction as a smaller facility," and it is this title that should be published as a legal notice.

Tulsans should also insist that this change not move forward unless and until the City begins to disentangle our priceless Gilcrease collection from the troubled University of Tulsa. The City should terminate its management contract with TU, reject any contributions from the Kaiser System (the name given by Michael Mason to the network of organizations linked to the Obama-backing billionaire), and insist that the collection remain at the same site. Any additional money needed could be reallocated from the dam project that will likely never happen. Some of these stipulations could be written into the Brown Ordinance to ensure compliance.

RELATED: President Trump tweeted on Wednesday:

The Tulsa, Oklahoma area has been approved for a transportation loan from the @USDOT of up to $120M to help expand highway on the Gilcrease Expressway West Project. This will mean less congestion and faster routes to popular spots! @GovStitt

The loan will be to the Oklahoma Turnpike Authority, which will repay the loan from the tolls it will be collecting on the five-mile stretch of the west leg of the Gilcrease Expressway between the I-44/I-244 west junction and US 412 at 57th West Avenue.

0 TrackBacks

Listed below are links to blogs that reference this entry: Council to change tax ordinance to enable Gilcrease demolition.

TrackBack URL for this entry: https://www.batesline.com/cgi-bin/mt/mt-tb.cgi/8692