March 2018 Archives

Wednesday night the Oklahoma State Senate passed the massive package of tax increases that was approved earlier in the week by the State House, and the bills were signed by Governor Mary Fallin. The largest tax bill, HB1010XX, passed by 36-10, including three Taxpayer Protection Pledge-breakers: State Senators Kim David, David Holt (Oklahoma City's mayor-elect), and AJ Griffin. Gov. Fallin is also a Taxpayer Protection Pledge-breaker.

Most Candidates for Governor have been very quiet about these taxes, but State Auditor Gary Jones expressed his support for the tax hikes on Facebook. Candidate Kevin Stitt denounced the tax increase and signed the seven-point Oklahoma Taxpayer Platform unveiled on Wednesday by Oklahoma Taxpayers Unite.

Here is the Oklahoma Taxpayer Platform:

- Fiscal Responsibility: We demand state and local government that is fiscally responsible, transparent and accountable. Heads of state agencies and local government entities should answer directly to elected officials. State agencies must be subjected to regular, independent fiscal and performance audits by the State Auditor and held accountable for the findings and recommended reforms. The 20 largest agencies should be audited no less than every 4 years. Establish a permanent, full-time Legislative Oversight Committee that is bipartisan, bicameral and has subpoena power. It will oversee each agency's mission and spending, and offer suggested legislation and reform, providing transparency and accountability.

- Limited Government: Focus on priorities. Most Oklahomans agree that state and local government should focus on four basic areas: public safety, transportation and infrastructure, education, and a safety net for the most vulnerable. Encourage and protect self-responsibility and liberty in religious expression, occupation, health care, education, etc. The first instinct of elected officials should be to limit government's reach.

- Structural Reform: We want structural reform to transform and eliminate governmental dysfunction, duplication and corruption. 500+ school districts are too many. Schools are bloated with administration. 500+ Agencies, Authorities, Boards, Trusts and Commissions are too much. Too many unelected officials are making decisions that affect taxpayers. Education and health would be better served by a dramatic downsizing of state bureaucracies, with more decisions made locally. We want fair legislative operating rules that do not abridge the right and responsibility of legislators to represent their constituents. Needed government services should be efficient and user-friendly.

- Fair Taxation: Tax people in the least-burdensome way. Income taxes impose a discouraging penalty on work, productivity, personal responsibility, savings, investment, capital formation and entrepreneurial risk-taking. No income taxes of any kind should be levied by Oklahoma's state and local government. Shift Oklahoma's tax structure to focus on consumption. This will help Oklahoma become a magnet for private-sector both large and small job creators and productive individuals of all incomes. The key is to attract more taxpayers, spreading the cost of state and local services among more people and allowing for a lower tax burden on everyone.

- Free-Market Environment: Preserve the gains made in Oklahoma in the past 20 years toward greater worker freedom and a less-adversarial legal climate. Remove unnecessary barriers set up by state and local government for many occupations. Encourage stronger market forces in health care, education, and other sectors, with less picking of winners and losers by government.

- Criminal Justice System Reform: We need criminal justice reform that keeps citizens safe but doesn't lock people up unnecessarily. Oklahoma can't afford the bankrupting costs and social dysfunction that go with leading the nation in the rate of incarceration.

- State Sovereignty: Provide a barrier between Oklahomans and Federal overreach that limits our Constitutional liberties. We cannot continue to let the Federal government impose restrictions, mandates and costs that infringe on our rights.

Oklahoma Taxpayers Unite reacted to the passage and signing of the tax increases with a news release:

In an era of big spending, big government, big egos and big lies, the passage of HB1010XX is a shameful slap in the face of Taxpayers and for many, a betrayal of their word of honor when they signed pledges NOT to raise taxes. Untrustworthy oath-breakers lead our state.For eight years, Governor Fallin and the GOP have had super majorities in the both the state Senate and House. They've squandered their opportunity to make structural reforms and institute real fiscal responsibility in state government. Now we've been subjected to the obscene applause and joy as they celebrated their abject failure of leadership while violating the very principles of their own Oklahoma GOP Platform.

Governor Fallin and the legislative leaders who pushed this are an embarrassment to their party, bring national shame to our state, and have betrayed Taxpayers who elected them. State Question 640 specifically mandates that ALL new tax increases be sent to the Taxpayers for a vote. The 75% supermajority vote of both Houses was meant to be used only for a real emergency, which this is not. Numerous proposals have shown how the teachers can get a pay raise without raising taxes.

You can watch the complete Oklahoma Taxpayers Unite press conference on the KOKH website. In his remarks, former U. S. Sen. Tom Coburn compared the passage of the tax hikes to the dishonest and cowardly process he witnessed first-hand at the U. S. Capitol:

"It had the suspension of rules, the lack of ability to read the bill, the lack of ability to offer amendments," Coburn said. "And the only leadership you had was to spend more and have less responsibility and less transparency in government."

Just a little bit before the OTU press conference was to begin, State House Rep. Mike Ritze, an opponent of the tax hikes, was headed to the press room when Ritze was confronted loudly by State Rep. Josh West, who voted to raise taxes, according to this report from David Van Risseghem of Sooner Politics:

As Ritze was walking alone on the 4th floor, he says Rep. Josh West, a freshman Republican started yelling at him for participating in the taxpayer advocacy group's meeting. As West (a tall former military vet) got even closer, he screamed; "YOU'RE STARTING A CIVIL WAR!".That outburst, and the encroaching movement caught the eye of a capitol public safety officer and he stepped up to the two house members. The presence of law enforcement evidently had a positive effect and West wisely recovered his senses & backed away.

This incident reminds me of the time a Tulsa City Council staffer went red with rage, shouting at me apparently because I came to the "pre-meeting" to report any action taken, camcorder in hand. Both situations seem to be a case of someone turning the guilt they feel at betraying the taxpayer against those who are exposing it.

Meanwhile, teachers are still going on strike, despite an average salary increase of $6,000 per year -- sorry, walkout. I'm told it isn't illegal because the teachers are only forbidden to strike in arbitration with their school board, to whom they are contracted, but in this case the school boards and administrators are in cahoots with the teachers and happy to send them to the State Capitol to shake the taxpayers down for more funds. Seems like there ought to be a law that restricts school administrators from closing school for political lobbying purposes. Even if the walkout doesn't violate the letter of the law, it surely violates the spirit and provides yet another example of why public-sector unions are a hazard to fiscal sanity and shouldn't be regarded in the same light as labor unions organizing workers in the private sector. Even Pres. Franklin Roosevelt, a friend to private labor unions objected to public-sector unions:

Meticulous attention should be paid to the special relations and obligations of public servants to the public itself and to the Government....The process of collective bargaining, as usually understood, cannot be transplanted into the public service.... A strike of public employees manifests nothing less than an intent on their part to obstruct the operations of government until their demands are satisfied. Such action looking toward the paralysis of government by those who have sworn to support it is unthinkable and intolerable.

Finally, Oklahoma Watch notes that the revenue sources that will produce the biggest share of the tax hike -- gross production tax, tobacco tax, fuel tax -- are highly volatile and may not consistently produce the revenue required for the pay increases that were also approved. That's rather rich, considering that the usual slam against the OCPA's plans for teacher pay raises without tax increases was that they used sources of revenue that weren't guaranteed year after year.

NOTE: I will be on 1170 KFAQ with Pat Campbell at 7:05 am on Wednesday, March 28, 2018 to discuss the tax increases passed by the Oklahoma House of Representatives last night and the path forward. Listen live on 1170kfaq.com or on the Tune In app. Later the interview will be posted on Pat Campbell's podcast page.

I'm disappointed but not surprised that the tax-eaters finally got their three-quarter billion dollar tax increase through the State House, with the largest tax bill, HB1010XX, passing by a vote of 79 to 19, a margin sufficient to bypass the constitutional requirement for ratification by a vote of the people in November. The proposal was introduced late in the afternoon and was passed a few hours later. In order to give the public a look at the bill before the vote, State Rep. Jason Murphey put the bill online, when it wasn't yet available on the official legislature website.

HB1010XX raises taxes on gasoline and diesel fuel (3 and 6 cents per gallon, respectively), on little cigars, cigarettes ($1 a pack), chewing tobacco (10%), and hotel rooms ($5 per day -- the definition of hotel is broad enough to affect campers at church camps and spiritual retreats like Falls Creek, and it looks broad enough to me to affect apartment renters, too; tribal casino hotels are, of course, exempt). The Gross Production Tax will increase from 2% to 5%. Another bill caps itemized deductions, effectively raising income taxes on middle-class Oklahomans.

If the bills pass the Senate, they will go into effect 90 days after the governor signs them into law. The 90-day delay was included in the constitutional process for tax increases to give citizens time to put a repeal of the tax on the ballot through the initiative petition process before the tax goes into effect.

The phenomenon I described in my previous piece, the dynamic that makes it easier for legislators to raise taxes than to root out waste, was in full effect yesterday. After the vote, it was disgusting to watch Republican legislators congratulating themselves on the tremendous achievement of passing a massive tax increase "for the first time in state history since 1990." At the very least, they ought to regard the vote as an admission of failure: After a decade of full Republican control, they had failed to clean up the state's finances and had to resort to a tax increase to fund teachers' raises, capitulating to a tiny Democratic minority's wish list of taxes and spending to get the votes they needed.

Why? Because the Republican legislative leadership and Governor Fallin have refused to work with the principled members of their caucus who insist on following the Republican Party platform and restraining the size and scope of government. Because these Republican elected officials refused to pursue any of the many proposals offered by the Oklahoma Council of Public Affairs (OCPA), the free-market, small-government think-tank, to raise teachers' salaries without raising taxes.

There seems to be genuine resentment and disdain on the part of the legislative leadership and the governor toward these principled organizations and individuals. I hear that legislative leaders refuse to work with OCPA and refuse to work with the Platform Caucus.

Remember when you were a teenager, the way you felt when your mom or dad or some other adult authority figure logically dismantled your carefully crafted excuses for not doing the right thing? I suspect that's the way legislative leaders feel about OCPA. They like the OCPA as much as the emperor liked the little boy who pointed out that his beautiful new clothes were non-existent.

One excuse I've heard is that one of OCPA's proposals last year required repurposing money in the Tobacco Settlement Endowment Trust fund in a way not expressly on the list of spending purposes permitted by Article 10, Section 40, of the state constitution.

Instead of changing the Oklahoma Constitution to make it easier to raise taxes, why not change the constitution and statutes to make it easier for the tax dollars we already send to the State Capitol and the county courthouses to get where they're really needed?

Oklahomans may have the impression (fed by sloppy reporting) that there's one big pot of tax money from which all state and local government expenditures are drawn. In fact, there are hundreds, maybe thousands of pots, large and small, earmarked for a specific purpose. That means that in the same year core governmental functions funded from the general fund are squeezed by revenue shortfalls, agencies with dedicated revenues may have far more money than they need.

The lazy legislator looks at that situation and says, "We have to put more money in the big general fund pot." What we need is for legislators to look at where money is going and where it is needed and then do the hard work of changing laws and constitutional provisions so the tax dollars we're already paying will go where they are needed.

Will that take a long time? Probably. Will it be hard work? Undoubtedly, with a lot of digging into details of budgets and spending and laws. Will it make some people angry? Certainly, especially those agency leaders who will lose their cushy earmarked funds and have to justify all of their spending each year. But hard work and making people angry is not a legitimate reason for legislators to avoid doing something. It's why we elected them.

(We did not, however, elect them so they could experience the Joy of Sex with new people they meet at the State Capitol. Some legislators over the years have been confused on this point. I suspect that confusion has led to moral compromise which has made said legislators more susceptible to compromising on their professed political principles.)

We should also expect our legislators to do the hard work of investigating and auditing state agencies, school districts, colleges, and other taxpayer funded entities and then implementing reforms in response to those audits. It is a difficult task, and it will make certain people feel threatened and angry, but legislators have a moral obligation to ensure that the tax dollars we entrust to them are wisely spent.

Of the 17 State House members who had taken the Taxpayer Protection Pledge for their current term of office, only 6 voted to uphold that pledge. The Taxpayer Protection Pledge for state legislators simply reads: "I, ____, pledge to the taxpayers of the State of Oklahoma, that I will oppose and vote against any and all efforts to increase taxes."

Here is the list of Oklahoma House pledge-breakers on HB1010XX: Earl Sears, Dustin Roberts, Josh Cockroft, Dennis Casey, Leslie Osborn, Charles Ortega, Mike Sanders, Scooter Park, Randy McDaniel, Chris Kannady, Michael Rogers. State Sen. Kim David is the Senate sponsor of the bill; her sponsorship makes her a pledge-breaker as well. I am happy that they took this step before the filing period for state office next month, and I hope challengers are ready to oppose them and the rest of the 51 Republicans who voted in favor of the biggest tax increase in nearly 30 years.

Even though Republican House leaders and their weak-willed followers voted to violate the party platform because of their failure to manage our tax dollars wisely, Oklahoma's affiliate of the leftist National Education Association is still planning an illegal strike on Monday because their entire list of demands were not satisfied. If the strike happens despite this massive tax increase, it will reveal the union as utterly unreasonable and should inspire support for repeal of the tax increases by the voters and defeat of the proposed constitutional amendment that would make it easier for the legislature to raise taxes without a vote of the people.

I'm happy to see conservative activists fired up to fight this tax increase. Steve Fair, a longtime grassroots leader in the Oklahoma Republican Party and former Republican National Committeeman, notes with disgust that no reforms of our tax-funded education system were required in exchange for these new taxes.

The disappointing thing is once again the education lobby won because self-described fiscal conservatives in control of the legislature caved. Education didn't have to agree to consolidate administrative services, school districts, or submit to comprehensive audits of school districts. They just threatened to walk-out and lawmakers caved. No Oklahoman disputes teachers in Oklahoma deserve a raise, but so do the butchers, bakers and candlestick makers. Unfortunately, those people can't afford to stage a walk-out because they can't afford to take the day off. They have to work to pay their taxes.

Former U. S. Senator Tom Coburn, renowned for his fight against government waste in Washington, will keynote the launch of a new organization, Oklahoma Taxpayers Unite!, tomorrow, March 28, 2018, at the State Capitol:

Fiscal hawk and Taxpayers' friend, Senator Tom Coburn, will announce the formation of a new Taxpayers' coalition to take the fight to the legislative tax hogs, oath breakers and Political Class.Oklahoma Taxpayers are fed up with legislative leadership that seeks first to raise taxes and refuses to make the structural, transformational reforms that fiscal responsibility requires. With HB1010XX, passed under duress and rules suspension March 26, the majority of the House of Representatives has chosen the path of more taxation instead of reform.

Oklahoma Taxpayers Unite! is a coalition of Oklahoma Taxpayers -- civic leaders, concerned citizens, grassroots activists, and party leaders, working together, demanding constitutional, ethical, transparent, and fiscally responsible governance for the Oklahoma Taxpayers. Reminiscent of the group known as "Stop New Taxes" which almost repealed HB 1017 28 years ago with a referendum petition, and then Oklahoma Taxpayers' Union, which successfully passed SQ 640, the new coalition reflects the disgust and anger with a Governor and legislature that has refused to lead, opting for new taxes instead.

Of the 79 House members who voted for new taxes, 11 of them previously signed a pledge for their entire term of office with Americans for Tax Reform, "to oppose [and vote against] any efforts to increase taxes." Apparently, their word means nothing. Two of the oath-breakers are running for higher office in 2018. Seven members of the Senate signed the same pledge.

Oklahoma Taxpayers Unite! will offer its 7-point Taxpayers Platform for all incumbents and candidates to pledge to on their Word of Honor.

At a time of life and with a record of accomplishment that would justify a quiet retirement, it's commendable that Tom Coburn would be willing to devote his time and his credibility to fixing waste in Oklahoma state government. May God grace us with more men and women of his integrity to serve in our State Capitol.

Last week the Oklahoma House approved HJR 1050 by a bare majority of 51 votes, pushed by the Chambercrat House Leadership, voting to erode the constitutional protection against tax increases without approval of the voting public. These 51 representatives, including two, Leslie Osborn and Glen Mulready, who are seeking higher office, voted to make it easier for politicians at the State Capitol to pass tax hikes without asking for voter approval. I'm embarrassed to see on the list of traitors to the taxpayers the names of legislators that I have endorsed and defended in the past.

Mainstream news coverage of Oklahoma's budget battle has given many voters the mistaken impression that a 75% legislative super-majority is the only constitutionally permissible way to raise taxes. When I corrected someone who made that assertion, I was told that I was absolutely wrong.

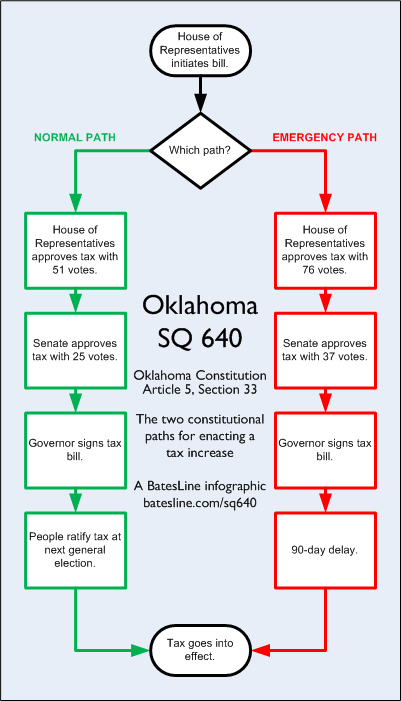

Article 5, Section 33, of the Oklahoma Constitution is best known by the initiative that enacted it: State Question 640. Here is the language:

§ 33. Revenue bills - Origination - Amendment - Limitations on passage - Effective date - Submission to voters.A. All bills for raising revenue shall originate in the House of Representatives. The Senate may propose amendments to revenue bills.

B. No revenue bill shall be passed during the five last days of the session.

C. Any revenue bill originating in the House of Representatives shall not become effective until it has been referred to the people of the state at the next general election held throughout the state and shall become effective and be in force when it has been approved by a majority of the votes cast on the measure at such election and not otherwise, except as otherwise provided in subsection D of this section.

D. Any revenue bill originating in the House of Representatives may become law without being submitted to a vote of the people of the state if such bill receives the approval of three-fourths (3/4) of the membership of the House of Representatives and three-fourths (3/4) of the membership of the Senate and is submitted to the Governor for appropriate action. Any such revenue bill shall not be subject to the emergency measure provision authorized in Section 58 of this Article and shall not become effective and be in force until ninety days after it has been approved by the Legislature, and acted on by the Governor.

Sections A and B apply to all revenue-raising bills. Section A echoes the Federal Constitutional requirement that revenue bills originate in the legislative chamber closest to the people. The normal path for measures raising revenue is described in Section C: Approved through the normal legislative process, then ratified by a vote of the people at the next general election.

Section D is intended for true emergencies, unforeseeable circumstances, like a natural disaster. The threshold is high enough to require agreement from every reasonable legislator, but not so high that a stubborn handful can block the measure in a true emergency.

For those of you more visually inclined, here's a flow chart:

The movement to limit the legislature's power to impose taxes was a reaction to HB 1017, the largest tax increase in Oklahoma history, enacted on April 19, 1990, by the legislature, without a vote of the people. At the time, Democrats had supermajorities in both houses of the legislature.

According to a story in the April 20, 1990, Daily Oklahoman, Corporate tax rates were increased by 20%, sales tax rates by 12.5%, and personal income tax rates by between 1.2% to 16%, depending on income level. Schools were required to meet accreditation standards, teachers' minimum salary scales were increased, maximum class sizes were lowered, and money was allocated to fund voluntary school consolidation for up to 250 of the state's then-604 school districts. (28 years later, Oklahoma still has 522 school districts.) News stories after HB 1017 went into effect report complaints from teachers and administrators that the extra money was appreciated, but the strings attached were making it hard to use the money wisely.

HB 1017 was approved in the wake of a week-long teachers' strike of questionable legality that began on April 16, 1990, called by the Oklahoma Education Association after an education funding bill failed to pass with an emergency clause for immediate effect. The strike was supported by a number of school districts.

Many Oklahomans felt that their elected officials caved to pressure from the teachers' union, ignoring the economic impact of higher taxes on the general public. Dan Brown, leader of Stop New Taxes, the movement opposing HB 1017's tax increases, described the reaction for the April 25, 1990, Daily Oklahoman:

These calls have been from retirees, teachers and administrators, small town newspaper editors and representatives of small and large businesses who feel betrayed by the Legislature and the governor, Brown said."In general, they fear the trend of government decisions being made by mob rule,'' he said. "They have lost their faith in our system and their belief that anyone at the Capitol hears them.''

While some opponents of higher taxes wanted to attempt an immediate repeal, the principal anti-tax organization at the time, Stop New Taxes focused on an initiative petition to restrict the legislature's ability to raise taxes without the direct assent of the taxpayers. In the early stages of the effort, Dan Brown described the intent:

"The taxes we plan to include in this petition include taxes on sales, personal and corporate income, ad valorem, service, etc.,'' Brown said. "We are not planning to include limitations on fees in this amendment.''He said the group is considering adding a provision that would allow the government to obtain money in emergencies, such as a severe prison riot or economic depression.

(An initiative petition to repeal the HB 1017 taxes, but which also added a variety of other reforms, did reach the ballot but not until November 1991, after the bill had already been in effect for a year, fell short, but nevertheless won 45.7% of the vote. Here is a timeline of events leading up to passage of HB 1017 and the attempt to repeal it.)

The heart of what became SQ 640 is this: At the State Capitol, it's easy for a legislator to forget where he came from and who he works for. He is surrounded by special pleaders for special interests. He finds himself becoming assimilated into the capitol subculture, developing an "us vs. them" mentality, where "us" consists of fellow legislators and the lobbyists that pretend to be his friends, and "them" consists of the rowdy, rude, ignorant electorate who got them into office and stupidly expects them to live up to their campaign rhetoric. The bureaucrats and lobbyists and legislative leaders tell him, and he begins to believe, that the Capitol endows its denizens with special knowledge that his constituents lack. His fellow Capitolines speak nicely to him, tell him what a couragous and brilliant man he is, admire him for growing in office, assure him that his betrayal of his campaign promises is just and wise. His betrayed campaign volunteers and constituents speak angrily to him, driving him further into the arms of his new love. The seed of legislative infidelity finds fertile soil.

The phenomenon of concentrated benefit trumping diffuse cost, explained by public choice theory, only compounds the problem: Advocates who are protecting or demanding a concentrated benefit will be better organized, more present, more passionate than the diffuse mass that will bear the cost. To the weak-kneed legislator, the demonstration on the Capitol steps will appear to be a bigger and more important political force than their constituents. Call it the puffer-fish effect: An organization making itself look bigger than it is for the purpose of intimidation. (The Federal Essential Air Service program is one instance of the phenomenon; pollution provides a non-economic example.)

This problem of alienation of legislative affection has been mitigated somewhat by several reforms: Legislative term limits that prevent legislators from making the Capitol a career and limit concentration of power through seniority, limits on the legislative calendar (February through May, Monday through Thursday) that allow a legislator to spend more time back home among his constituents, and SQ 640, which prevents taxes being enacted hastily in response to pressure from those who would benefit from the tax increase. Either there has to be a near-universally acknowledged emergency, or there will be a cooling-off period in which tax advocates have to persuade the general electorate that a tax increase is necessary.

Over 230,000 signatures were gathered on an initiative petition to put SQ 640 on the ballot. While the proponents had wanted the issue on a general election ballot, Democrat Gov. David Walters scheduled it for March 10, 1992, perhaps hoping that special interest groups would be able to turn out their voters to defeat it. Even so, Oklahoma voters approved SQ 640 by a significant margin: 373,143 to 290,978, 56.2% to 43.8%.

Since its passage, a number revenue increases have gone into effect. In a column from earlier this year, OCPA President Jonathan Small listed several within the last decade:

As you might expect, some lawmakers are now looking to wage war against 640. They claim it confines government by making any revenue-raising measures impossible to pass. But that's not true.In 2009, 2010, and 2011, legislators organized bipartisan supermajorities to pass bills that raised some $224 million in new annual state funds and $268 million in annual matching federal dollars.

Press releases from the executive branch, Board of Equalization reports, and legislative budget summaries show that the 2015, 2016, and 2017 legislative sessions combined to annually increase revenue for appropriation by more than $500 million.

Moreover, Oklahoma has raised personal income tax rates, cigarette taxes, gaming taxes, and authorized a state lottery (a tax on the poor) since 640 was adopted by voters.

So mostly during Republican majority control, annually recurring revenues were raised more than $724.7 million.

HB 1017 was something of a pyrrhic victory for public-employee unions and their Democratic allies in the legislature. It provoked a taxpayer revolt that resulted in passage of term limits that fall, followed in 1992 by SQ 640. Democratic supermajorities gave way to Republican supermajorities and a sweep of statewide elective offices. Statewide initiatives to raise taxes for education have been defeated overwhelmingly -- SQ 744 in 2010, 19% to 81%; SQ 779 in 2016, 41% to 59% -- which may explain why our weasely state reps thought they need to make it easier to raise our taxes without asking our permission.

The teachers' union and their allies seem intent on blocking any improvement for teachers that doesn't also kill or cripple SQ 640 and raise taxes permanently. The fact that a decent increase in minimum teachers' salaries could be funded without raising taxes seems to have inspired them to double their demands and expand them beyond the classroom to include state bureaucrats. As in 1990, they may succeed in intimidating a majority in the legislature to do their bidding, but as in 1990, their victory may lead to long-lasting damage to their political clout.

As passionate as many Oklahomans are about their local public schools, particularly in small towns where the school system is about the only thing keeping the town from dying, an increasing number feel alienated from public education. They see a system mired in the latest educational fads, entranced by political correctness, discarding tried-and-true for novel and trendy, and sometimes directly hostile to the values they believe should undergird education. They see problems that no amount of money can fix; accelerating down the wrong track will never get the train to its destination. The good will Oklahomans have toward teachers may not extend to the beneficiaries of the OEA's other demands, and it may not even extend to giving teachers a much greater raise than most Oklahoma taxpayers have received over the last decade.

An interview with Swedish author Johan Norberg explores the reality behind the Left's fantasies about Nordic socialism. Read the whole thing, but notice below the historical context that preceded the Swedish welfare state and the effect it had on the Swedish work ethic. To borrow Ronald Reagan's phrase, the safety net has become a hammock.

First, Norberg describes the economic and political liberty that transformed Sweden in the late 19th century:

Q: In a speech before the Free Market Foundation, you outlined the rise, fall, and subsequent rise of Sweden's economic standing. Can you give an abridged version of that history lesson to our readers? Why and how did Sweden rise, then fall, then rise once again?A: This is an incredibly important story because for some reason, the "Swedish model" got very famous for the way it appeared for about 15 or 20 years in the 1970s and 1980s. That was the moment in time when everybody looked at Sweden and thought, "something interesting is going on there," and for some reason, that perception froze in time, in that era -- but it's just a tiny bit of Swedish history, and also, I would say, a scary example of what could go wrong.

The short version of our long history is that in the middle of the 19th century, Sweden was one of the poorest countries in Europe. My ancestors in Northern Europe starved for lack of modern industry, railways, food trade, and agricultural productivity. However, at that time, in the 1850 and 1860s, we had a group of classical liberal Swedish politicians who really opened Sweden up. They democratized politics, deregulated markets and businesses, and turned Sweden into a free trade nation. Suddenly, we could make exports to richer countries, we could begin to mechanize the old trades, and increase productivity dramatically, and we had 100 years of growth that basically turned Sweden from one of the poorest counties in Europe into one of the world's richest countries.

This was the moment in time when the "Swedish model" was open markets, free trade, and a very limited government. During the period in which we grew the fastest, our government spending wasn't more that 10% of GDP, and as late as the early 1950s, our government was smaller, and our taxes were lower than in the rest of Europe and in the United States -- so that's really something people tend to forget when they tell people to look at the successful "Swedish model." We were one of the richest countries on the planet -- in 1970, the fourth richest -- before we built the welfare state, before we had this third way, semi-socialist model. So, we created that wealth first. But when you're rich, you want to spend it, and that's what they did.

As usual, ignorant people without a sense of history or cause and effect decided that because the system wasn't perfect, they would break it and substitute something new.

In the 1970s, the Social Democrats in charge began to redistribute big time, and they began to regulate businesses, and for a period of some 20 years, we doubled the size of public spending in Sweden. This is exactly the thing that people still think about when they talk about the "Swedish model" in the U.S. and other places. People said, "Look, this is a country that has begun to tax and spend and regulate much more than we do, and they're incredibly rich. Everything seems to be working quite well." Of course, we were rich because we had created all that wealth -- but it's like that old joke. How do you end up with a small fortune? You start with a big fortune! Then you just make some mistakes, and lose most of it -- and that's what we did.The period in the 1970s and 1980s was the one period in Sweden's economic history where we really began to lag behind other countries, and mess up in a big way. It all ended in a terrible crisis after an inflation boom in the early 1990s, when we, for a period of time, had an interest rate of 500% to try and protect our currency. It all came tumbling down.

After that, we began to return to some of our roots. We began to deregulate markets again, began to liberalize and produce things like private providers in healthcare, a school voucher system on a national level, and partially privatize pension, and so on. Since then, Sweden has done much better again.

This is the whole irony of the story. When people like Bernie Sanders and others talk about the successful socialist "Swedish model," they talk about those 15 to 20 years of awful economic and social results when real wages didn't increase at all....

We see the usual Leftist ignorance of human nature, assuming that behavior will remain unchanged when the incentives change. (An important factor Norberg doesn't address is the undermining of Christianity by Socialists and liberals. How do you maintain a "strong Lutheran work ethic" when people are no longer strong Lutherans?)

...we had Social Democrats in Sweden who said that this is the best place in the world to experiment with socialism because we already had these great foundations to make it work. We had wide-spread social trust, so people trusted one another, and they trusted the government. A strong Lutheran work ethic means we would work even though taxes might make it less economically beneficial. People would never accept welfare if they could work. We had already built all this wealth. What some of them said is, "If it doesn't work in Sweden, it can't work anywhere."What happened -- even in Sweden -- this began to undermine our foundations in various ways. Cultures don't exist in vacuums, and if there are no institutions, no incentives that encourage them, they begin to fall apart -- and that's what happened in many ways. Work ethic decreased; our tradition of not accepting government benefits if they weren't needed began to erode as well. It used to be that when we were asked something like, "under what circumstances is one justified in accepting government benefits to which one is not entitled," we were always ahead of everyone else, 80% to 90% would say, "never." That has begun to erode down to some 50% to 55%, which is higher than many other countries, but it tells you something about what has changed....

This definition of socialism is spot-on: "Authoritarianism applied to the economy."

[Socialism is] basically trying to reorganize society from above. It's really a way of not accepting the spontaneous outcome of millions of everyday choices regarding how to work, what to work with, whom to reward by paying them, by buying their goods and services. So, in a way, it's authoritarianism applied to the economy. As a result of that, it's the economic system that is the hardest failure of the 20th century. We've never seen a system be so totally discredited everywhere it's been tried. The basic reason is that one person at the top -- or a few politicians and bureaucrats -- if they are trying to guide the system of prices and economic rewards, as well as which businesses to benefit, it's a way of replacing millions of decisions every minute made by people in their local circumstances based on their local knowledge, and replacing it with only the knowledge of a few people at the top. They always have less knowledge; they can't try out the many experiments that millions of people can try over time, and that's why it fails again and again....

To the idea that socialism would be great, but it's never been implemented correctly:

If your system is dependent on it being run by the best of people, and anything else results in chaos and poverty and breadlines, it's probably not a good system. I think that's what we've learned from history. The best political theorists and economists have always said that we should always try to organize society and our laws and our politics to make sure that bad people can create as little damage as possible because we always end up with wrong people in certain places implementing stupid policies at the wrong moment. If you have a system that only works if that never happens, then you probably have the wrong system.

There's much more good stuff in the interview: Why young people are drawn to socialism, the real cause behind "failures" of capitalism, why you have to squeeze the lower and middle class to have socialism.

You'll find more of Johan Norberg's work at his website.

It is the first day of DST in the United States and everyone is groggy and cranky and wondering why we bother with changing the clocks twice a year. There are the usual calls to go to DST and stay there forever, or stay with standard time forever.

The last two Novembers I've spent some time in a place that doesn't have DST: the Australian state of Queensland. Australia has three principal time zones: Australian Western Standard Time (GMT+8 hours); Australia Central Standard Time (GMT+9.5 hours); and Australian Eastern Standard Time (GMT+10 hours). But from the first Sunday in October to the first Sunday in April, the south-central and southeastern states go on DST, while Western Australia, the Northern Territory, and Queensland remain on standard time. During this period you have the strange situation where you can drive 70 miles due south of Brisbane, and it's suddenly an hour later.

On November 30, late spring in Brisbane, Queensland's capital, dawn (civil dawn) comes at 4:18 am and dusk ends at 6:54 pm. On the longest day of the year, dawn comes at 4:23 am and dusk ends at 7:09 pm. For most people, that means 90 minutes or more of daylight while you're still trying to sleep, and yet it still gets dark not long after supper. Many Queenslanders would like to move that hour of early morning light to a more useful time.

As bad as at is to have the sky brightening when it should be oh-dark-thirty, Brisbane, a subtropical city with a relatively small fluctuation in the length of days over the course of the year, doesn't get the worst of it. The farther you get from the equator, the higher the latitude, the longer the days and the more sunshine is wasted. In Hobart, Tasmania, dawn would break on the solstice at 3:53 am without DST, but DST pushes that to 4:53 am and pushes nightfall from 8:24 pm to 9:24 pm -- more time after work for outdoor activities.

So if the problem is the distribution of sunlight around the work day, is there another way to solve it?

Idea #1: Move to DST permanently. But then, when you get to late autumn and winter, there's no sunlight at as people are going to work and school. If we still had DST in December, dawn would break at 8 am in Tulsa.

Idea #2: Stay on standard time permanently and move business hours to improve the amount of daylight after work. The challenge here is unpredictability. Some businesses would adjust hours, some wouldn't.

Idea #3: Designate sunrise on any given day as 6 am and reckon hours from that point of reference. A business that opens its doors at 8 am would always be starting two hours after sunrise. One problem with that idea is the same problem that led to the creation of time zones in the first place, when every town measured time by local noon; drive a few miles east or west and your watch would suddenly be off by a minute. Measuring time by sunrise would add a north-south variation to time calculation. It was bad enough to have local time variations when we could travel at 60 mph, but imagine the chaos dealing with local time variations now that we can communicate at the speed of light.

It turns out that moving clocks forward an hour in the spring and back in the fall is a pretty good compromise between all these competing concerns.

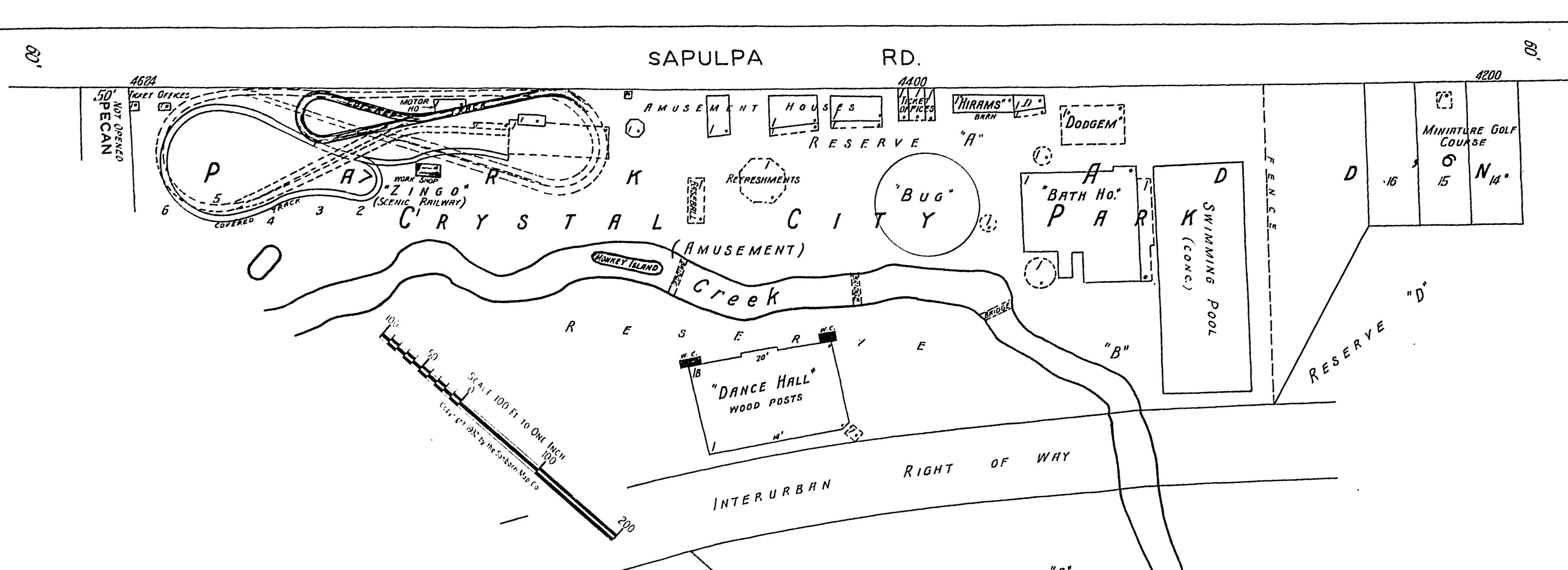

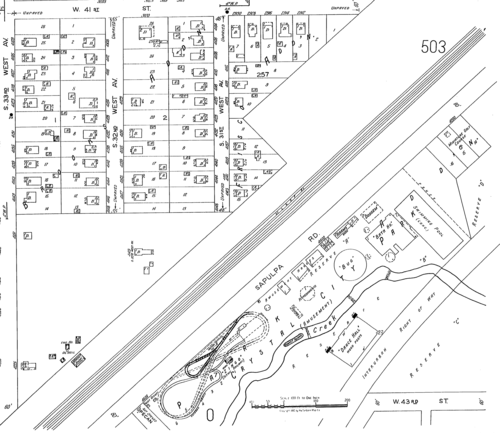

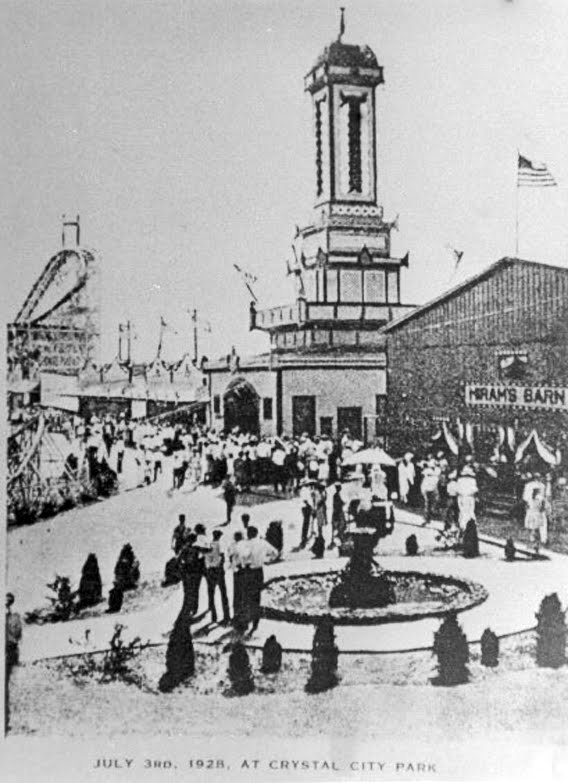

Crystal City Amusement Park was on Route 66 (Sapulpa Road, now Southwest Blvd) between 41st Street and 33rd West Avenue. The site is now occupied by the Crystal City Shopping Center (whose name was the nemesis of radio announcers). Crystal City was home to a roller coaster named Zingo, which became the namesake for the wooden coaster at Bell's decades later. A Sanborn fire insurance map from June 1932 shows Zingo ("scenic railway") hugging the highway, a stream flowing through the property (with a monkey island in the middle of it), a massive dance hall, a giant pool with a large bath house, "amusement houses", Dodgem (bumper cars), a ride called "Bug," a few smaller rides, an octagonal refreshment building, ticket offices, and something called Hiram's Barn. TulsaGal has photos of Crystal City Amusement Park from the late 1920s that show many of these features. The image above, showing Hiram's Barn, a tall tower (possibly over the ticket offices), and part of the Zingo roller coaster, is from that entry.

(Click the picture to open a very large version of the map in a popup window.)

This north-up map provides some context, showing the park in relation to 33rd West Ave., 41st Street, Sapulpa Road (now Southwest Blvd), and the Frisco (now BNSF) tracks.

According to the County Assessor's records (parcel 31125-92-27-17380), the Crystal City Shopping Center was built in 1954 and sits on 442,060 sq. ft. of land, a bit more than 10 acres, about the same size as Bell's footprint at the Tulsa County Fairgrounds. Comparing the Sanborn map (Volume 3, Map 501) to the assessor's map, it appears that the highway department routed I-244 around the shopping center, taking homes to the east and moving the Tulsa-Sapulpa Union tracks further east as well. The site of the old amusement park is fully intact.

The shopping center was sold at auction in 2013 to Monticello Acquisitions LLC for $565,000. The new owners began to renovate the property and attract new tenants.

Most of the information above comes from an entry posted on September 26, 2011, but as the hopes expressed in that entry have been overtaken by events, I am reposting with updated information.

A significant number of the 35% of Tulsa Public Schools who left the district in the last two years did not head to greener pastures out-of-state, but to other Oklahoma school districts with comparable pay, according to an investigation led by Tulsa World education reporter Andrea Eger. Teachers interviewed for the story cited poor leadership and lack of respect from administrators at district and school level as the main reason for seeking a new place of employment.

I encourage you to read the article at the World's website, but here's a summary to give you a sense:

Teachers mentioned overly prescriptive curricula that had them reading from a script or coordinating laptop-based instruction, reducing the teacher from a creative instructor to a mere "computer lab attendant" and making it impossible for teachers to learn and respond to the individual struggles of their students.

One veteran foreign language teacher quit to take a lower-paying gig as a freelance photographer: ""It was 100 percent the awful administration and the district showing us they didn't care."

Discipline, or the mandatory lack thereof, seems to have significantly damaged teacher morale and inspired departures and early retirements. Robert Dumas, a former Memorial Jr. High teacher criticized the all-positive, all-the-time news from district headquarters, saying, "Our suspensions are down because they stopped suspending kids for the same things." Mike McGuire, now retired from East Central High, suggested that the state aid formula, which is based on average daily attendance, might be a motivation for reducing the number of suspensions.

Mr. McGuire then dropped this bombshell, which (I hope) will get an investigation of its own (emphasis added):

McGuire said his tipping point was being formally reprimanded for how he responded to students concerned about two of their classmates being allowed to return to school after 10 days in jail on human trafficking complaints."I told my students, especially the girls, 'If you're concerned, you need to tell your parents so they can express their concern to their school board representative,' " McGuire said. "If my daughters were going to school in a place with pimps running around it, I would want to know."

Apparently the paramount value for Tulsa Public Schools administration is making the administration look good. It's not a problem to have pimps in school; it is a problem to let parents know so they can take action to protect their children.

(This reminds me of the time, in 2000, that I got scolded by Jeannie McDaniel, then head of the Mayor's Office for Neighborhoods for Susan Savage, for alerting Crosbie Heights neighborhood leaders to a plan to demolish half of it for an amusement park. McDaniel didn't seem to be bothered that influential people intended to destroy the neighborhood, but that neighborhood leaders were panicked because they'd been told about it.)

Hats off to the Tulsa World reporters who produced this investigation and to the editors who gave it the green light. At a time when it's common wisdom to blame every school problem on the amount of state aid (and Superintendent Deborah Gist tried that gambit in this story), it would have been easy to bury the story for the sake of maintaining that narrative or out of fear that the story would provide fodder for the "wrong" people.

Meanwhile Deborah Gist is focused like a laser on the important issue of schools wrongly named after honorable and heroic men of history like Christopher Columbus and Robert E. Lee.

Just remember, folks: The TPS preliminary expenditure budget for 2017-2018 was $561,241,887 for an average daily membership for the first nine weeks of the year of 37054.40. That's $15,146.43 per student.

MORE: One of the teachers interviewed for the story mentioned a "student behavior management system" called "No-Nonsense Nurturing," which, combined with very scripted curriculum, became "too much to bear." On Twitter, Abigail Prescott links to an essay by a teacher explaining the No-Nonsense Nurturing system, which evidently involves coaches in the back of the classroom giving commands to the teacher through an earpiece, which she is supposed to carry out in a monotone. The World story quotes Superintendent Gist as saying that "TPS is committed to the philosophy that suspending students isn't a real solution to underlying behavior issues and noted that it offered the new behavior management strategy called 'No Nonsense Nurturing' only in response to personal concerns expressed to her by teachers when she first arrived in summer 2015."