Tulsa Election 2019: November 2019 Archives

Postdated to remain at the top through the end of the election. Polls are open in the City of Tulsa November 12, 2019, special election from 7 a.m. to 7 p.m. The Oklahoma State Election Board's new Oklahoma Voter Portal will tell you where to vote and let you view sample ballots before you go to the polls.

I have no illusions. The election is a classic example of concentrated benefit and diffuse costs. Those who stand to benefit directly from the new taxes on the ballot have strong reasons to give money to the vote yes campaign and to turn out to vote. The cost, although nearly as much as Vision 2025 and over $1500 for every resident of this shrinking city, is divided up among all the property owners and all those who shop in the city limits of Tulsa. There is no organized opposition to the three tax questions.

And yet, I'm hearing from many people that they plan to vote against at least one of the three propositions, for a variety of reasons:

- Because it's daft to invest another $427 million in a financially unsustainable growth paradigm.

- Because, for the first time in the nearly 40-year-history of Tulsa's "Third Penny" sales tax for capital improvements, none of the money will go toward basic infrastructure.

- Because you're outraged that the City of Tulsa would force people from their homes and demolish a historic neighborhood to build a stormwater detention pond to benefit new home construction.

- Because you're generally tired of the City of Tulsa abusing its power of eminent domain and hollowing out our historic urban core in the process.

- Because the current tax expires at the end of June 2021, and the City could have scheduled this vote for the November 2020 mayoral (and presidential) general election, when the turnout would have been much higher, rather than wasting tax dollars on a special election.

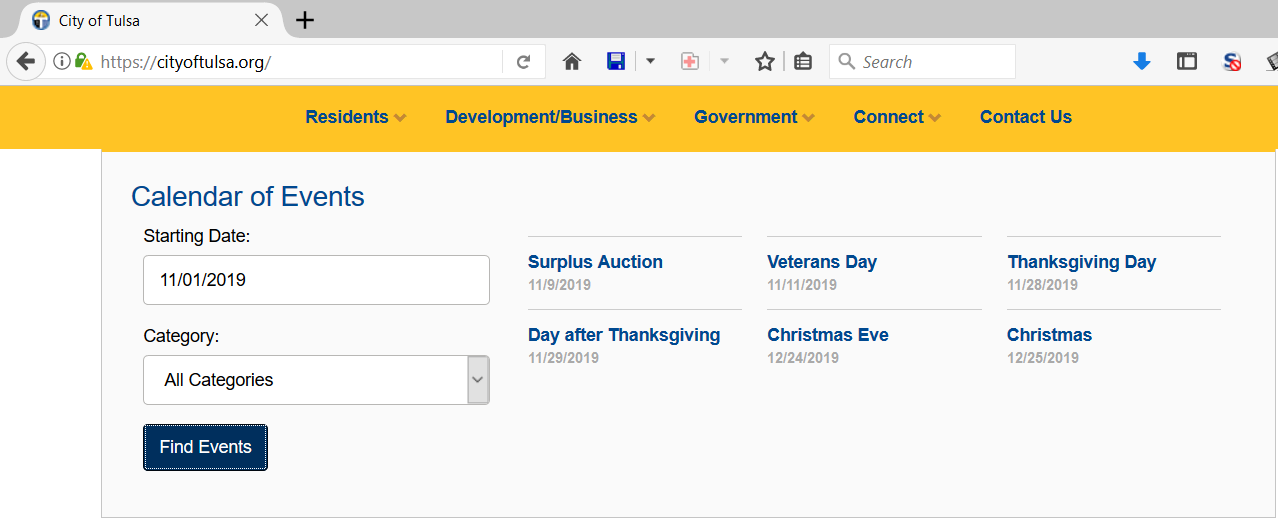

- Because the City still doesn't list the election on the cityoftulsa.org calendar of events, or in the city's list of press releases, or anywhere else on the home page, or on the city's Twitter account -- apparently trying to discourage turnout except among those with a vested interest in the tax increases being approved.

- Because you think Mayor G. T. "Selfie" Bynum IV should maybe focus on Tulsa's crime rate and declining population.

- Because you think Mayor Bynum IV should have the guts to defend his tax proposal and record as mayor on the air with a courteous but skeptical radio host like Pat Campbell.

- Because we already gave $65 million to Gilcrease Museum and $25 million to the Tulsa Zoo in the 2016 Vision Tulsa package, and they don't need another $6 million EACH just three years later. (This looks a lot like payola.)

- Because you're tired of Bynum IV & Co. enshrining the deadly religious beliefs of the Sexual Revolution as official City of Tulsa policy.

Nothing wakes up government officials as quickly as depriving them of the money they were expecting to spend.

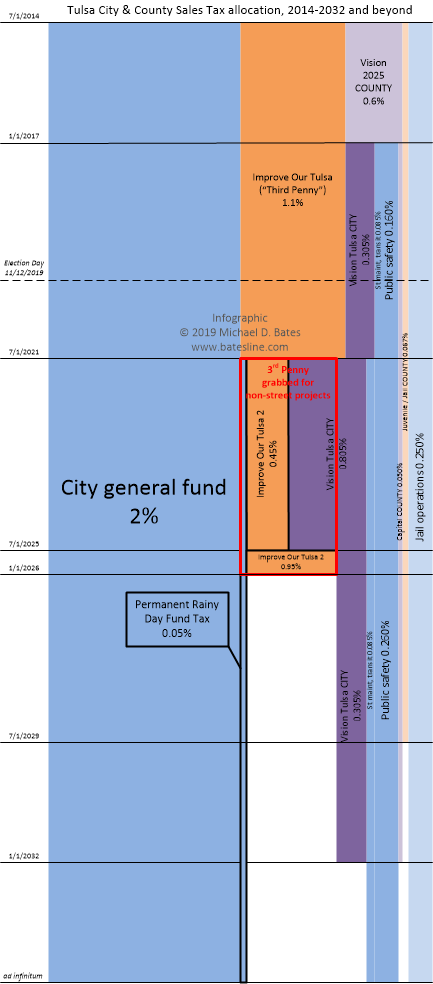

Click here for just the facts about the tax proposals on today's ballot, including the official legal descriptions of each, and a diagram showing a timeline of City of Tulsa and Tulsa County sales taxes, both permanent and temporary, and how the proposals on the ballot fit into the big picture. And don't miss city planner Brent Isaacs' analysis of the general obligation bond issue for streets from an economic sustainability perspective.

I was on AM 1170 KFAQ with Pat Campbell on Wednesday, November 6, 2019, at 8:05 a.m. to discuss the upcoming City of Tulsa sales tax vote. Click the link to hear the podcast. A couple of callers mentioned the City of Tulsa's declining population: They were correct, and I was wrong. The U. S. Census Bureau's estimate of Tulsa's population peaked at 404,182 in 2016, then declined to 402,119 in 2017 and 400,669 in 2018. Nothing bulldozing a few more neighborhoods won't cure, eh, Mayor Bynum IV?

Also, here is the City of Tulsa's Bond Transparency Act disclosure, as of June 30, 2019, which lists the outstanding principal for each bond issue as of that date ($395,600,000 total) and details bond issues linked to previous elections. Some current bonds will mature this year, others won't mature until 2040, and there is still $160,000,000 authorized but not yet issued from the 2014 Improve Our Tulsa bond package. Add the proposed $427 million to the total and we're at $982.6 million in outstanding and authorized general obligation debt -- nearly a billion dollars. Here is a direct link to the Bond Transparency Act Disclosure on the city's website, linked from the City of Tulsa's capital projects page. And here's the bond document for one specific bond series, City of Tulsa General Obligation Bonds, Series 2014, authorized by the 2013 Improve Our Tulsa vote. You can explore more bond documents on emma.msrb.org.

Next Tuesday, November 12, 2019, voters in the City of Tulsa will be presented with three questions for funding capital improvements through a temporary increases in property tax and sales tax and a permanent sales tax increase for the city's "rainy day fund."

You can be forgiven for not knowing about this election. It has been omitted from the calendar of events that appears on the home page of the official city website:

The home page mentions the Veterans' Day holiday, a parking ticket amnesty, and a surplus property auction. It doesn't mention the election.

The first sheet of the ballot contains a single proposition, which, if approved, would result in a general obligation bond issue to be repaid by an increase in property tax:

PROPOSITION IMPROVE OUR TULSA(Streets and Transportation Systems

Construction and Repair Bonds)Shall the City of Tulsa, Oklahoma, incur an indebtedness by issuing its bonds in the sum of Four Hundred Twenty-Seven Million Dollars and No Cents ($427,000,000.00) to provide funds (either with or without state or federal aid) for the purpose of constructing, reconstructing, improving, repairing and/or purchasing streets and transportation systems, as authorized by Article X, Section 27 of the Oklahoma Constitution and the laws of the State of Oklahoma, and levy and collect an annual tax, in addition to all other taxes, upon all taxable property in said City, sufficient to pay the interest on said bonds as it falls due, and also to constitute a sinking fund for the payment of principal of said bonds when due, said bonds to bear interests of not more than the maximum rate permitted by law at the time the bonds are issued, payable semiannually and to become due serially within twenty-five (25) years from their date?

(It's very odd that this proposition has a name instead of a number, while the other two propositions are numbered.)

The second sheet of the ballot contains two numbered propositions, both of which would increase the sales tax:

PROPOSITION NO. 1 SALES TAX PROPOSITION NO. 1Improve our Tulsa - 2021

Miscellaneous Capital Improvements

Temporary Sales TaxDo you approve collecting a forty-five one-hundredths of one percent (.45%) temporary sales tax, commencing at the expiration of the 2014 Extended 1.1% Sales Tax, and continuing until June 30, 2025, when it shall become ninety-five one-hundredths of one percent (.95%), and continuing at that rate from July 1, 2025 until either December 31, 2025 or until One Hundred Ninety-Three Million Dollars and No Cents ($193,000,000.00) has been collected, whichever occurs first, at which point it shall expire; to be deposited into a limited-purpose fund; to be used for acquiring, purchasing, constructing, reconstructing, maintaining, repairing and enhancing certain capital improvements, in accordance with Ordinance No. 24180?

PROPOSITION NO. 2

SALES TAX PROPOSITION

NO. 22021 Limited-Purpose Economic Stabilization Reserve Permanent Sales Tax (Rainy Day Fund)

Do you approve collecting a permanent sales tax of five one-hundredths of one percent (.05%) commencing at the expiration of the 2014 Extended 1.1% Sales Tax, to provide revenue for the City's Economic Stabilization Reserve, also known as the Rainy Day Fund, pursuant to Tulsa City Charter Article II, Sections 7.4 through 7.9, any amounts collected that would cause total monies in the Economic Stabilization Reserve to exceed thirty percent (30%) of actual total General Fund revenues being allocated to the General Fund Emergency Operating Reserve; any amounts collected that would cause total monies in the General Fund Emergency Operating Reserve to exceed ten percent (10%) of the total General Fund budget being allocated to the General Fund, for maintenance and operation of municipal infrastructure, facilities, and equipment?

Here is the ordinance enacting the new sales tax in Proposition No. 1, officially known as the 2021 Miscellaneous Capital Improvements Temporary Sales Tax, and the "Brown ordinance" spelling out the list of projects to be funded by the new temporary tax. Here is the ordinance enacting the permanent new sales tax in Proposition No. 2. These were all enacted at the July 31, 2019, Tulsa City Council meeting.

The graphic at the top of this entry shows the changes in city and county sales tax rates going back to the beginning of the Improve Our Tulsa tax in 2014 and continuing on to infinity and beyond. You can download a printable copy of the graphic, with a legend and explanatory text, and tax opponents are welcome to make unaltered copies for distribution.