Tulsa Election 2019 Category

Postdated to remain at the top through the end of the election. Polls are open in the City of Tulsa November 12, 2019, special election from 7 a.m. to 7 p.m. The Oklahoma State Election Board's new Oklahoma Voter Portal will tell you where to vote and let you view sample ballots before you go to the polls.

I have no illusions. The election is a classic example of concentrated benefit and diffuse costs. Those who stand to benefit directly from the new taxes on the ballot have strong reasons to give money to the vote yes campaign and to turn out to vote. The cost, although nearly as much as Vision 2025 and over $1500 for every resident of this shrinking city, is divided up among all the property owners and all those who shop in the city limits of Tulsa. There is no organized opposition to the three tax questions.

And yet, I'm hearing from many people that they plan to vote against at least one of the three propositions, for a variety of reasons:

- Because it's daft to invest another $427 million in a financially unsustainable growth paradigm.

- Because, for the first time in the nearly 40-year-history of Tulsa's "Third Penny" sales tax for capital improvements, none of the money will go toward basic infrastructure.

- Because you're outraged that the City of Tulsa would force people from their homes and demolish a historic neighborhood to build a stormwater detention pond to benefit new home construction.

- Because you're generally tired of the City of Tulsa abusing its power of eminent domain and hollowing out our historic urban core in the process.

- Because the current tax expires at the end of June 2021, and the City could have scheduled this vote for the November 2020 mayoral (and presidential) general election, when the turnout would have been much higher, rather than wasting tax dollars on a special election.

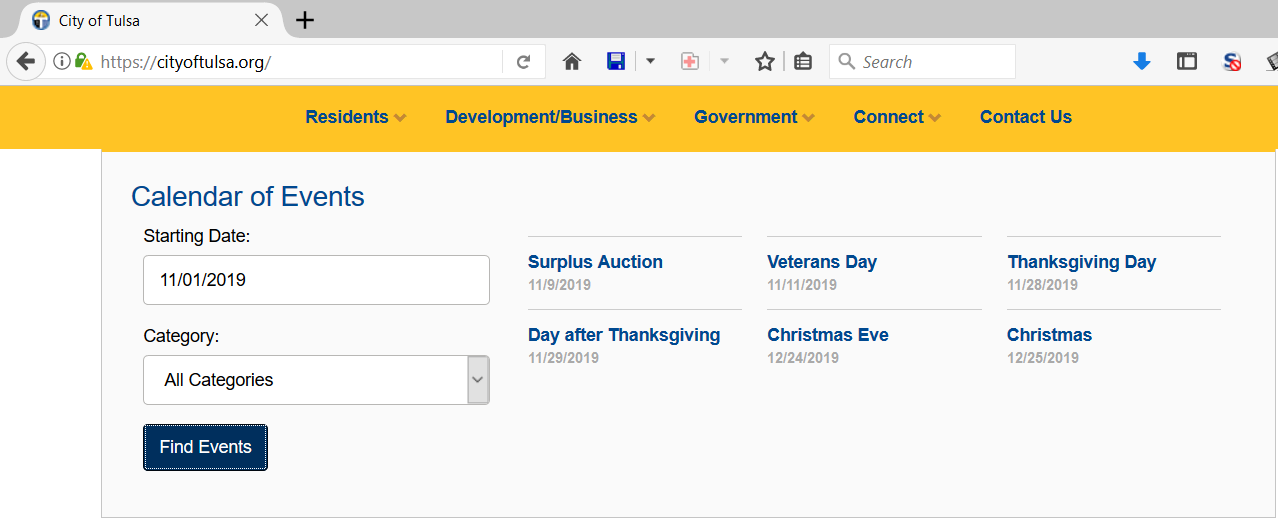

- Because the City still doesn't list the election on the cityoftulsa.org calendar of events, or in the city's list of press releases, or anywhere else on the home page, or on the city's Twitter account -- apparently trying to discourage turnout except among those with a vested interest in the tax increases being approved.

- Because you think Mayor G. T. "Selfie" Bynum IV should maybe focus on Tulsa's crime rate and declining population.

- Because you think Mayor Bynum IV should have the guts to defend his tax proposal and record as mayor on the air with a courteous but skeptical radio host like Pat Campbell.

- Because we already gave $65 million to Gilcrease Museum and $25 million to the Tulsa Zoo in the 2016 Vision Tulsa package, and they don't need another $6 million EACH just three years later. (This looks a lot like payola.)

- Because you're tired of Bynum IV & Co. enshrining the deadly religious beliefs of the Sexual Revolution as official City of Tulsa policy.

Nothing wakes up government officials as quickly as depriving them of the money they were expecting to spend.

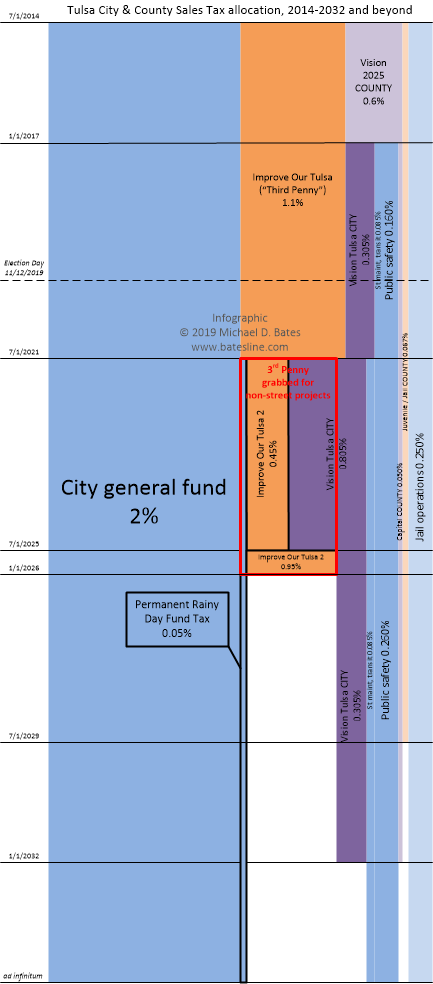

Click here for just the facts about the tax proposals on today's ballot, including the official legal descriptions of each, and a diagram showing a timeline of City of Tulsa and Tulsa County sales taxes, both permanent and temporary, and how the proposals on the ballot fit into the big picture. And don't miss city planner Brent Isaacs' analysis of the general obligation bond issue for streets from an economic sustainability perspective.

I was on AM 1170 KFAQ with Pat Campbell on Wednesday, November 6, 2019, at 8:05 a.m. to discuss the upcoming City of Tulsa sales tax vote. Click the link to hear the podcast. A couple of callers mentioned the City of Tulsa's declining population: They were correct, and I was wrong. The U. S. Census Bureau's estimate of Tulsa's population peaked at 404,182 in 2016, then declined to 402,119 in 2017 and 400,669 in 2018. Nothing bulldozing a few more neighborhoods won't cure, eh, Mayor Bynum IV?

Also, here is the City of Tulsa's Bond Transparency Act disclosure, as of June 30, 2019, which lists the outstanding principal for each bond issue as of that date ($395,600,000 total) and details bond issues linked to previous elections. Some current bonds will mature this year, others won't mature until 2040, and there is still $160,000,000 authorized but not yet issued from the 2014 Improve Our Tulsa bond package. Add the proposed $427 million to the total and we're at $982.6 million in outstanding and authorized general obligation debt -- nearly a billion dollars. Here is a direct link to the Bond Transparency Act Disclosure on the city's website, linked from the City of Tulsa's capital projects page. And here's the bond document for one specific bond series, City of Tulsa General Obligation Bonds, Series 2014, authorized by the 2013 Improve Our Tulsa vote. You can explore more bond documents on emma.msrb.org.

Next Tuesday, November 12, 2019, voters in the City of Tulsa will be presented with three questions for funding capital improvements through a temporary increases in property tax and sales tax and a permanent sales tax increase for the city's "rainy day fund."

You can be forgiven for not knowing about this election. It has been omitted from the calendar of events that appears on the home page of the official city website:

The home page mentions the Veterans' Day holiday, a parking ticket amnesty, and a surplus property auction. It doesn't mention the election.

The first sheet of the ballot contains a single proposition, which, if approved, would result in a general obligation bond issue to be repaid by an increase in property tax:

PROPOSITION IMPROVE OUR TULSA(Streets and Transportation Systems

Construction and Repair Bonds)Shall the City of Tulsa, Oklahoma, incur an indebtedness by issuing its bonds in the sum of Four Hundred Twenty-Seven Million Dollars and No Cents ($427,000,000.00) to provide funds (either with or without state or federal aid) for the purpose of constructing, reconstructing, improving, repairing and/or purchasing streets and transportation systems, as authorized by Article X, Section 27 of the Oklahoma Constitution and the laws of the State of Oklahoma, and levy and collect an annual tax, in addition to all other taxes, upon all taxable property in said City, sufficient to pay the interest on said bonds as it falls due, and also to constitute a sinking fund for the payment of principal of said bonds when due, said bonds to bear interests of not more than the maximum rate permitted by law at the time the bonds are issued, payable semiannually and to become due serially within twenty-five (25) years from their date?

(It's very odd that this proposition has a name instead of a number, while the other two propositions are numbered.)

The second sheet of the ballot contains two numbered propositions, both of which would increase the sales tax:

PROPOSITION NO. 1 SALES TAX PROPOSITION NO. 1Improve our Tulsa - 2021

Miscellaneous Capital Improvements

Temporary Sales TaxDo you approve collecting a forty-five one-hundredths of one percent (.45%) temporary sales tax, commencing at the expiration of the 2014 Extended 1.1% Sales Tax, and continuing until June 30, 2025, when it shall become ninety-five one-hundredths of one percent (.95%), and continuing at that rate from July 1, 2025 until either December 31, 2025 or until One Hundred Ninety-Three Million Dollars and No Cents ($193,000,000.00) has been collected, whichever occurs first, at which point it shall expire; to be deposited into a limited-purpose fund; to be used for acquiring, purchasing, constructing, reconstructing, maintaining, repairing and enhancing certain capital improvements, in accordance with Ordinance No. 24180?

PROPOSITION NO. 2

SALES TAX PROPOSITION

NO. 22021 Limited-Purpose Economic Stabilization Reserve Permanent Sales Tax (Rainy Day Fund)

Do you approve collecting a permanent sales tax of five one-hundredths of one percent (.05%) commencing at the expiration of the 2014 Extended 1.1% Sales Tax, to provide revenue for the City's Economic Stabilization Reserve, also known as the Rainy Day Fund, pursuant to Tulsa City Charter Article II, Sections 7.4 through 7.9, any amounts collected that would cause total monies in the Economic Stabilization Reserve to exceed thirty percent (30%) of actual total General Fund revenues being allocated to the General Fund Emergency Operating Reserve; any amounts collected that would cause total monies in the General Fund Emergency Operating Reserve to exceed ten percent (10%) of the total General Fund budget being allocated to the General Fund, for maintenance and operation of municipal infrastructure, facilities, and equipment?

Here is the ordinance enacting the new sales tax in Proposition No. 1, officially known as the 2021 Miscellaneous Capital Improvements Temporary Sales Tax, and the "Brown ordinance" spelling out the list of projects to be funded by the new temporary tax. Here is the ordinance enacting the permanent new sales tax in Proposition No. 2. These were all enacted at the July 31, 2019, Tulsa City Council meeting.

The graphic at the top of this entry shows the changes in city and county sales tax rates going back to the beginning of the Improve Our Tulsa tax in 2014 and continuing on to infinity and beyond. You can download a printable copy of the graphic, with a legend and explanatory text, and tax opponents are welcome to make unaltered copies for distribution.

Brent Isaacs, a native Tulsan and city planner active for many years in advocating for a better Tulsa, has has written a piece below about why you should to vote against the first item on the November 12, 2019, Tulsa ballot. Labeled on the first sheet of the ballot as "PROPOSITION IMPROVE OUR TULSA (Streets and Transportation Systems Construction and Repair Bonds)," it is a $427,000,000 general obligation bond issue "for the purpose of constructing, reconstructing, improving, repairing and/or purchasing streets and transportation systems," which will be paid for by an increase in property tax rates within the City of Tulsa.

(A second sheet contains two numbered propositions, both of which would raise the sales tax rate: Proposition 1, a 0.45% sales tax, later increasing to 0.95%, and expiring in 2025, would fund miscellaneous capital improvements. Proposition 2, a 0.05% permanent sales tax, would put money in the Economic Stabilization Reserve, aka the Rainy Day Fund.)

When Brent posted an earlier version of this essay on Facebook, I commented that the Engineering Services Department is like a computer, and it's running a program that it was given to run 50 years ago. The neighborhood-destroying zombie project that is the Elm Creek West Pond is another case in point. It's time that Tulsans, through our vote on November 12 and through our support for candidates for mayor and city council in 2020, terminated the current, outdated program and launched a newer, better program that takes these economic realities into account. He has kindly granted permission to publish an updated version of his essay here at BatesLine.

Why I am Voting No on Improve our Tulsa 2's Streets and Transportation Package

Brent C. Isaacs, AICP, 10/29/19

Tulsa is trapped in a structural infrastructure deficit- and that's why I am voting no on Improve our Tulsa 2, item one on November 12. Item one is a general obligation bond for mostly street projects. Say what? Why would I vote no? Wouldn't that make the problem worse?

I get that there are legitimate capital improvement needs for our city, the third penny sales tax is up for renewal and there will be no tax increase required. I wanted to vote yes, and will do so on item three that would create a standing "Rainy Day" fund for the City, and leaning toward voting yes on item two, for all the non-street projects that will be funded by extending the third penny sales tax. Normally, I am in favor of all propositions funding capital improvement projects but this time I have decided to vote no on the streets package. Here's why.

1. When it comes to streets, Improve our Tulsa 2 is doing the same thing we have been doing for over 40 years and it hasn't worked. Yes, streets have been widened and improved but we are still are no closer to ending our structural infrastructure deficit.

The land area in Tulsa grew dramatically in 1966 when the number of square miles in the city limits more than doubled nearly overnight. While that allowed for a population increase and allowed the City to capture sales tax revenue from the booming growth to the south and east, it also created demand, particularly for new street infrastructure, that has yet to be met. For a while, as the growth periphery continued to largely be in Tulsa's city limits, sales tax dollars continued to increase. However, over the last 20 years, as the growth periphery has moved beyond the Tulsa city limits to places like Jenks, Bixby and Broken Arrow, the growth in sales tax revenue has slowed dramatically and City operating costs just to maintain the same level of service have outpaced available tax revenue. The population of the city of Tulsa has been around 400,000 for nearly the same time frame.

Now we are faced with not only having to add infrastructure just to catch up with all the sprawling growth for neighborhoods developed long ago, but also having to rehabilitate infrastructure that was built in the 1960s, 70s and 80s that is largely worn out. Item one, the general obligation bond for $427,000,000, includes $64,000,000 for additional street widening with $295,800,000 for existing street repairs. But, this is just a portion of what's reported to be needed. The current capital improvement needs list is estimated to be in the billions. This is occurring as the city is no longer growing in population, sales tax revenues are flat and operating costs for the City of Tulsa are increasing faster than tax revenue.

2. The current growth patterns that have been fueled by our street infrastructure investments aren't sustainable.

The reality is that we cannot continue to invest in street infrastructure that does not more than pay for itself and fund its replacement with regular sales tax revenue. Otherwise, we will never get caught up. By continuing the cycle of investing in more of the same infrastructure, we are facilitating low density sprawling development that will not adequately pay for the cost of this infrastructure.

Joe Minicozzi, Principal and Founder of fiscal, development and tax analysis firm Urban 3 (http://www.urban-three.com/), stated in a 2012 Atlantic Cities article, now Citylab (https://www.citylab.com/life/2012/03/simple-math-can-save-cities-bankruptcy/1629/) "Low-density development isn't just a poor way to make...tax revenue. It's extremely expensive to maintain. In fact, it's only feasible if we're expanding development at the periphery into eternity, forever bringing in revenue from new construction that can help pay for the existing subdivisions we've already built."

This describes the situation in Tulsa accurately. The only way to fund all this street infrastructure and even possibly get caught up is to dramatically increase sales and property taxes. This is largely viewed as being politically unfeasible and, as I argue below, is economically unwise.

3. Infrastructure should generate additional wealth for a city, not create additional tax burdens.

Minicozzi and Chuck Marohn, Founder and President of Strong Towns (https://www.strongtowns.org/), an organization promoting smart, incremental development that is financially sustainable for cities, have created models showing the amount of property tax created per acre for different types of development. They have showed that while everyone thinks a big Walmart on a suburban site will generate an enormous amount of tax revenue, because of the infrastructure required to service such a large site, the amount of property tax revenue per acre is much lower than traditional denser development found in downtowns and older urban neighborhoods. While the City of Tulsa is dependent on sales tax, not property tax, revenue to fund operations, locally the Urban Data Pioneers civic group attempted to do a similar analysis of Tulsa development patterns based on sales tax revenue in 2017. The picture was largely similar.

Thus, for example, when considering street improvements, we need to look at more than just traffic counts or the pavement condition index. We need to consider what type of development will this facilitate and will it generate additional tax revenue that more than covers the cost of the improvement and provides replacement cost funding.

4. The list of street projects included in a proposal needs to be subjected to more than just the analysis from Engineering Services. The economic value created and whether the improvement facilitates the type of city Tulsans desire should be part of the selection criteria.

As I currently understand it, Engineering Services maintains the list of needed capital improvement projects. Street projects are reviewed and ranked to determine which have the greatest need based on traffic counts, age, pavement condition index, etc. However, nowhere in these is the level of economic activity, tax revenue likely to be generated and whether the type of development helps create Tulsans' desired city, considered. With a few exceptions, Engineering Services largely controls the capital improvement process.

The most recent gauge of what Tulsans would like for our city is the Tulsa Comprehensive Plan, that came out of PlaniTulsa. It represents the views what thousands of Tulsans said they wanted our city to look like. Currently, the plan is administered by the Tulsa Planning Office at INCOG. They should have a formal role in reviewing and determining which capital improvement projects are needed to achieve this vision.

Besides opening the process up to the Tulsa Planning Office, there should be an independent economic analysis done for projects to determine whether they generate additional tax revenue or economic activity that exceeds their original and replacement costs. Ultimately, a project selection committee should be formed that makes the final recommendations on projects based on these criteria to the Mayor.

5. The City has done a poor job managing and completing construction on existing capital improvement projects that have already been funded.

You don't have to look far to see projects, particularly projects impacting our streets, that have taken a really long time or have been redone multiple times in Tulsa in recent years. As I speak, there has been a large hole on Denver right in front of 5th Street by Central Library and the Tulsa County Courthouse that has been there for weeks and weeks. Nothing seems to really be happening but it is causing back ups regularly for people going to court, the library or the BOK Center. I don't understand why there hasn't been more a sense of urgency in getting this inconvenient construction completed. Or, outside of downtown, Lewis between 11th and 21st Streets has been in different stages of construction for years. First, it was redoing the intersection at 15th and Lewis, then multiple projects from 15th to 21st Streets, then work from the Broken Arrow to 11th Street to narrow the street creating on street parking. Now, with the work on the Broken Arrow Expressway bridges over 15th and Lewis, the area is torn up again. I don't understand why these projects, along with countless others, couldn't have been better coordinated and completed in a much shorter timeframe.

Tulsans have expressed frustration with continual street construction. Bumper stickers have been spotted that say "Tulsa...finish something!" or "Welcome to the City of Road Construction". I realize that construction is often the price of progress but can't we figure out a way to do it better? Other cities don't seem to have as much constant construction as Tulsa does.

While some people will say voting no on the street improvements will halt progress in our city, I disagree. There are plenty of capital improvement projects, including streets, that have been approved by the voters but have yet to be completed. In the meantime, can't we rethink our street capital improvements approach and come back with a new proposal that considers these options above? Tulsans deserve better and we should start now.

Brent C. Isaacs, AICP, is a local urban planner in Tulsa.

Four Tulsa County K-12 school board seats in Tulsa, Keystone, Broken Arrow, and Union districts are on the ballot today, Tuesday, April 2, 2019, along with a seat on the Tulsa Technology Center board, and City Council or Town Trustee seats in Broken Arrow, Bixby, Catoosa, Glenpool, Jenks, Skiatook, and Sperry.

The full list of contests for the April 2, 2019, election is on the Oklahoma State Election Board website. You can check to see if you have a reason to go to the polls by going to the online voter tool, entering your name and date of birth, and see if it shows you a sample ballot for today's election. (I don't have one.) Those polling places with elections will, as usual, be open from 7 a.m. to 7 p.m.

For the first time, school board races that drew only two candidates are on the April ballot, to be decided at the same time as two-candidate runoffs for races in which no one reached a majority during the February primary election.

In the Tulsa school district, Office No. 1, which covers west of the Arkansas River, the Sand Springs Line, downtown Tulsa, and most of the neighborhoods surrounding downtown, is open after long-time incumbent and Democrat operative Gary Percefull opted not to run for re-election. Two candidates emerged from a field of eight in February:

Nicole Nixon is the mom of two children who attend TPS's Clinton Middle School, where she serves as a parent volunteer. "I don't have 10 years for Tulsa Public Schools to get its act together." Nixon is a conservative Republican who ran in last year's race for the open House 68 seat. Nixon lives west of the river in Mountain Manor neighborhood. Nixon's top concern is the current administration and board's decision to close schools on the west side; she describes the west side as being blindsided by the decision. Nixon would like to see Tulsa school budget tax dollars stay local, rather than getting spent on out-of-state consultants. Nixon is an advocate for local control of educational decisions by teachers and parents, rather than top-down control from district HQ. If elected, she would be the only self-identified conservative on the seven member Tulsa school board. I'd hope that a political perspective that has a majority in the district would have at least some representation on the board. KFAQ's Pat Campbell interviewed Nicole Nixon last Friday.

Nixon's opponent is Stacey Woolley, a registered Democrat who lives in the North Maple Ridge historic district. In one Facebook post, Woolley applauded leftist Senator Kamala Harris's call for more Federal involvement in local schools. Another post shows one of her sons in a T-shirt reading "Boys will be boys."; the photo is cropped at the bottom, but it appears to be this shirt, with the full text reading, "Boys will be boys. Good Humans!" which suggests a belief on behalf of whoever bought the shirt that there's something inherently evil in being male. How Woolley raises her own children is her business, but at a time when boys are conspicuously lagging behind girls at every level of education, when teachers bias grades in girls' favor, I'd want to be sure that our school board member celebrates boys' unique qualities, rather than regarding boys as defective girls.